The 2026 tax year will bring several important tax changes for Americans. These changes come mainly from a new tax law often referred to as the One Big Beautiful Bill Act, which keeps and expands many earlier tax rules. The goal of the law is to extend prior tax cuts and introduce new deductions for certain groups of taxpayers. While many households are expected to see at least some level of tax relief, the biggest gains are not expected to be spread evenly.

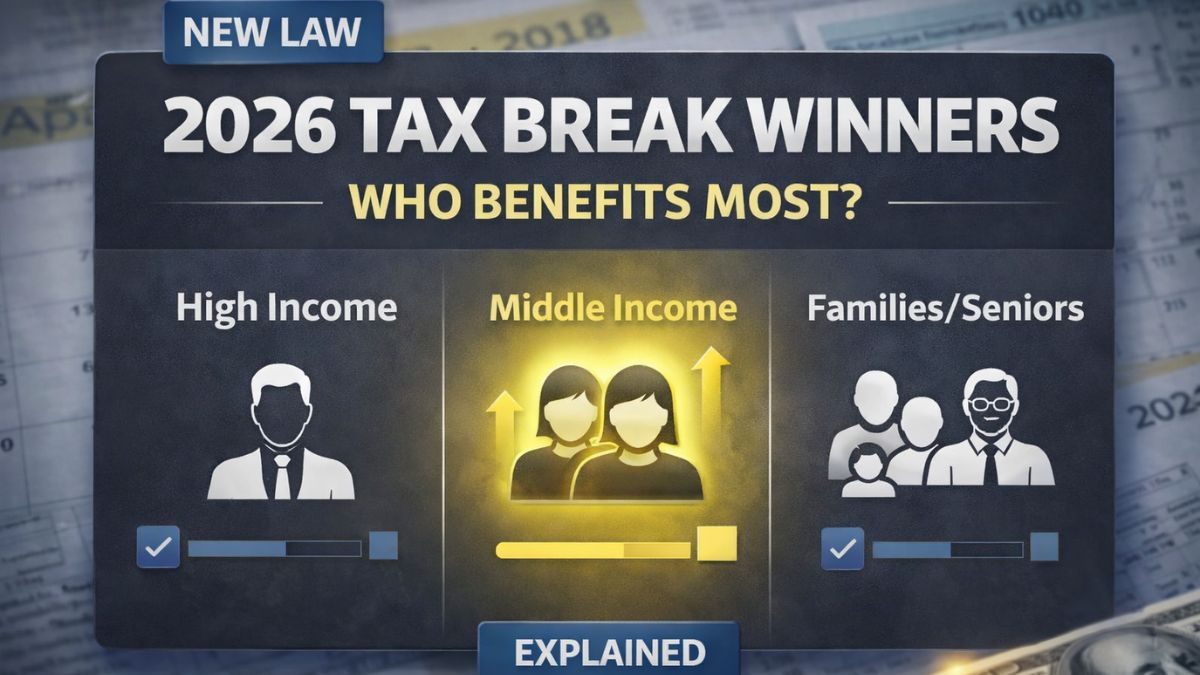

Tax research groups and financial analysts generally agree that higher-income households are likely to receive the largest share of the total tax savings in 2026. Middle-income and lower-income families may still benefit, but usually by smaller amounts. Understanding how these changes work can help taxpayers better prepare and plan before filing.

What Major Tax Changes Take Effect in 2026

Several updates will shape how 2026 tax returns are calculated. Some earlier tax rules have been made permanent, which means they will no longer expire after a short period. This creates more long-term stability in tax planning but also locks in who benefits most from each provision.

Among the widely discussed updates are an inflation-adjusted child tax credit, a new extra deduction available to many seniors, and a charitable deduction that can now be claimed even by people who do not itemize their deductions. These changes are designed to give broader access to certain tax benefits and reduce taxable income for qualifying filers.

There are also adjustments to deduction limits and bracket thresholds. Because of inflation indexing, some deduction amounts and income cutoffs will rise over time, slightly increasing the value of certain breaks.

Why Higher-Income Households Gain More Overall

Even though tax cuts are available across income levels, the total dollar value of benefits is expected to be larger for higher-income households. Tax policy analysts estimate that a majority of the total tax savings will flow to taxpayers in the top income ranges.

One major reason is how deductions work compared to credits. Deductions reduce taxable income, and the higher a person’s tax bracket, the more each dollar of deduction is worth. For someone in a high tax bracket, a large deduction can translate into substantial tax savings. For someone in a lower bracket, the same deduction produces a smaller benefit.

Higher-income taxpayers are also more likely to itemize deductions instead of taking the standard deduction. Itemizing allows them to claim specific expenses and taxes paid, which can significantly lower their taxable income when limits are generous.

The Expanded SALT Deduction Plays a Big Role

One of the most important drivers of larger benefits for high earners is the increase in the deduction cap for state and local taxes, often called the SALT deduction. The new law raises the cap far above its previous level for several years.

This change mainly helps taxpayers who pay high amounts of state income tax and property tax. These taxpayers are often higher earners and homeowners in higher-tax states. With a larger cap, they can deduct more of those payments on their federal return, lowering their taxable income and final tax bill.

Because lower-income households tend to pay less in state and local taxes overall, and are less likely to itemize, they benefit less from this specific change.

Average Savings Differ by Income Level

Tax research estimates suggest the average taxpayer may see a few thousand dollars in reduced taxes under the updated rules. However, averages can be misleading because savings are not evenly distributed.

Higher-income filers are projected to receive a larger share of the total tax reduction. A significant portion of the overall benefit pool is expected to go to the top income group. Meanwhile, many lower-income households will receive smaller cuts, and in some cases only modest changes compared to prior years.

This difference is not necessarily because lower earners are excluded, but because the structure of deductions and itemized benefits favors those with larger taxable incomes and higher deductible expenses.

Why Middle-Income and Lower-Income Families See Smaller Cuts

Middle-income and lower-income families will still see helpful changes, but often at a smaller scale. Many of these households rely more on the standard deduction and tax credits rather than itemized deductions. While credits can be very valuable, several of them include income phaseout rules.

Income phaseouts mean that once earnings rise above certain levels, the value of a credit or deduction begins to shrink. Some of the newer provisions aimed at workers and families include these limits. As income rises past the threshold, the benefit is reduced or removed.

Expanded standard deductions help non-itemizers, but when a household’s tax bill is already relatively low, the total savings from a larger deduction is naturally limited. This leads to smaller dollar gains compared with high-income itemizers using multiple large deductions.

New Senior and Charitable Deductions Still Offer Help

Not all new provisions favor high earners. The additional deduction available to many seniors can reduce taxable income for older taxpayers who qualify. This is especially helpful for retirees living on fixed incomes who may not itemize deductions.

The above-the-line charitable deduction for non-itemizers is another supportive change. It allows taxpayers who use the standard deduction to still claim a limited deduction for qualified charitable giving. This expands access to a benefit that previously helped mostly itemizers.

While these provisions may not create very large refunds, they can still make a meaningful difference for eligible households.

What This Means for 2026 Tax Planning

The 2026 tax landscape rewards planning more than ever. Higher-income households will likely see the largest automatic gains due to expanded deduction limits and itemizing advantages. However, taxpayers in other income groups can still take steps to improve their outcomes.

Reviewing eligibility for new deductions, checking credit phaseout ranges, and adjusting paycheck withholding can all help avoid surprises. Seniors should verify whether they qualify for the additional deduction. Donors should keep records of charitable gifts. Workers should confirm that their withholding matches the updated brackets.

Professional tax advice may be especially useful this year because the rule changes are broad and sometimes technical. A careful review can uncover benefits that might otherwise be missed.

Disclaimer

This article is for informational and educational purposes only. It summarizes general tax law changes and projected impacts but does not provide tax, legal, or financial advice. Tax outcomes vary based on individual circumstances, income levels, and filing choices. Laws and guidance may change. Readers should consult official tax authorities or a qualified tax professional for advice specific to their situation before making tax decisions.