Social Security spousal benefits are an important part of retirement income planning for many couples in the United States. These benefits allow one spouse to receive payments based on the other spouse’s work record. This can be especially helpful when one partner spent years out of the workforce, worked part-time, or earned much less. In 2026, the core rules remain the same, but updated earnings limits and cost-of-living adjustments can affect how much households receive. Understanding how spousal benefits work can help couples make smarter decisions and increase their total retirement income.

What Social Security Spousal Benefits Mean

Spousal benefits are retirement payments that a husband or wife can receive based on their partner’s Social Security record. Instead of relying only on their own work history, an eligible spouse can claim a portion of the other spouse’s full retirement benefit. The system was designed to support households where earnings were uneven or where one spouse focused more on caregiving or household responsibilities.

These benefits are managed by the Social Security Administration and are separate from survivor benefits. Spousal benefits apply while both spouses are alive and one is drawing retirement benefits. The goal is to make sure retirement support is shared more fairly within a marriage.

Basic Qualification Rules in 2026

To receive spousal benefits in 2026, a person must meet several basic conditions. The person claiming must generally be at least 62 years old. The couple must be legally married, and the marriage must have lasted at least one continuous year before applying. In addition, the higher-earning spouse must have already filed for their own retirement benefits. Without that first claim, spousal benefits cannot be paid.

Divorced individuals may also qualify under special rules. If the marriage lasted at least ten years and the person is currently unmarried, they may claim spousal benefits based on their former spouse’s record. Even in divorce cases, the higher earner must be eligible for benefits, though they do not always have to be actively collecting yet if the divorce has been final long enough.

How the Spousal Benefit Amount Is Calculated

The spousal payment is based on the working spouse’s full retirement benefit amount, often called the primary insurance amount. At full retirement age, an eligible spouse can receive up to half of that figure. The percentage is tied to the worker’s full benefit, not what they actually receive after early or delayed claiming.

If the spouse claiming benefits also has their own work record, both amounts are compared. Social Security pays the higher of the two, not both added together. In practice, this means a person first qualifies for their own earned benefit, and then a spousal add-on may be applied if the spousal amount is higher. The combined payment is adjusted so the total equals the spousal level, not double benefits.

The Importance of Full Retirement Age

Full retirement age plays a major role in determining how much a spouse can receive. For most people retiring in 2026, full retirement age is 67. Claiming spousal benefits before reaching that age leads to a permanent reduction in the monthly amount. The earlier the claim is made after age 62, the larger the reduction.

Waiting until full retirement age allows the spouse to receive the maximum possible spousal percentage. Unlike personal retirement benefits, spousal benefits do not grow larger if delayed beyond full retirement age. There are no delayed retirement credits for the spousal portion, so waiting past full retirement age usually does not increase that specific benefit.

Working While Receiving Spousal Benefits

Some people claim spousal benefits while they are still working. When benefits are taken before full retirement age, an annual earnings limit applies. If earnings go above that limit, part of the Social Security payment may be temporarily withheld. The limit is adjusted from time to time and is higher in 2026 than in earlier years.

After reaching full retirement age, the earnings limit no longer applies. A person can continue working and earning any amount without having their Social Security payments reduced due to wages. This rule is important for couples who plan a gradual transition into retirement instead of stopping work completely.

Strategies to Help Maximize Spousal Payments

Couples often increase their total household income by coordinating when each partner claims benefits. Since the spousal benefit depends on the higher earner’s record, it is often helpful for the higher earner to review the timing of their own claim carefully. In many cases, delaying the higher earner’s retirement benefit increases the base amount that influences other related benefits.

The lower-earning spouse may benefit from waiting until full retirement age to claim the spousal portion so they can receive the full percentage. Careful timing decisions can produce a noticeable difference in long-term retirement income. Reviewing earnings records and estimated benefits ahead of time supports better choices.

Payment Timing and Annual Adjustments

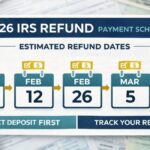

Spousal benefits follow the same monthly payment schedule as regular retirement benefits. Payment dates are usually based on the beneficiary’s birth date and are sent once per month. Deposits are typically made electronically into bank accounts.

Annual cost-of-living adjustments are applied automatically when approved. These increases are designed to help benefits keep pace with inflation. Beneficiaries usually receive a yearly notice showing their updated monthly amount. Reviewing that notice helps retirees confirm that their expected spousal benefit is being paid correctly.

Why Couples Should Plan Together

Retirement planning works best when couples look at their Social Security options together rather than separately. Decisions made by one spouse can directly affect the other. Understanding ages, benefit estimates, and claiming options allows couples to choose a strategy that supports both partners over the long term.

Learning the rules about early claiming, full retirement age, and earnings limits helps avoid costly mistakes. Many retirees lose money simply because they claim too early without understanding the reduction. A coordinated approach can provide more stability throughout retirement.

Final Thoughts

Social Security spousal benefits in 2026 remain a valuable source of support for married and formerly married retirees. They help balance income between partners and protect spouses who had lower lifetime earnings. Qualification depends on age, marriage history, and the filing status of the higher-earning spouse. The amount depends heavily on timing and full retirement age rules. With proper planning and informed decisions, couples can use spousal benefits to strengthen their retirement finances.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or retirement advice. Social Security rules, benefit amounts, and eligibility conditions may change. Individual situations vary. Always review your personal record and consult official government sources or a qualified retirement advisor before making benefit decisions.