Social Security payments in February 2026 are especially important for millions of Americans who depend on these monthly deposits to cover basic living costs. Retirees, disabled individuals, and surviving family members often rely on this income to pay rent, buy food, manage heating bills, and afford necessary medicines. During the winter months, expenses are usually higher, which makes payment timing and benefit amounts even more important.

February can feel financially stressful because it follows the holiday season and includes higher winter utility costs. It is also a shorter month, which leads to confusion and worry among some beneficiaries. Understanding how the payment schedule works and how the cost-of-living increase affects benefits can help people plan their budgets with more confidence.

Why February Often Causes Payment Worries

Many Social Security recipients believe that February payments may be reduced or delayed because the month has fewer days. This belief has circulated for years, but it is not correct. The number of days in a month does not change the amount of Social Security benefits. Monthly payments are calculated using benefit formulas, not calendar length.

What can change is the exact deposit date. When a scheduled payment date falls on a weekend or a federal holiday, the payment is usually sent earlier. This is done so beneficiaries are not forced to wait longer due to bank closures. Even when the payment arrives earlier than expected, it still represents the full monthly amount.

Understanding this rule helps reduce unnecessary panic when people see deposits arrive on a different date than usual.

How the Social Security Payment Schedule Works

Social Security payments are not sent to everyone on the same day. The system uses a staggered schedule to spread deposits across the month. This reduces pressure on banking systems and helps ensure smoother processing.

Payment timing is mainly based on two things: when a person first started receiving benefits and their date of birth. People who began receiving benefits many years ago, as well as those who receive both Social Security and Supplemental Security Income, are typically paid near the beginning of each month. Others receive their payments on specific Wednesdays based on their birth date range.

This structure remains steady throughout the year and does not change just because it is February.

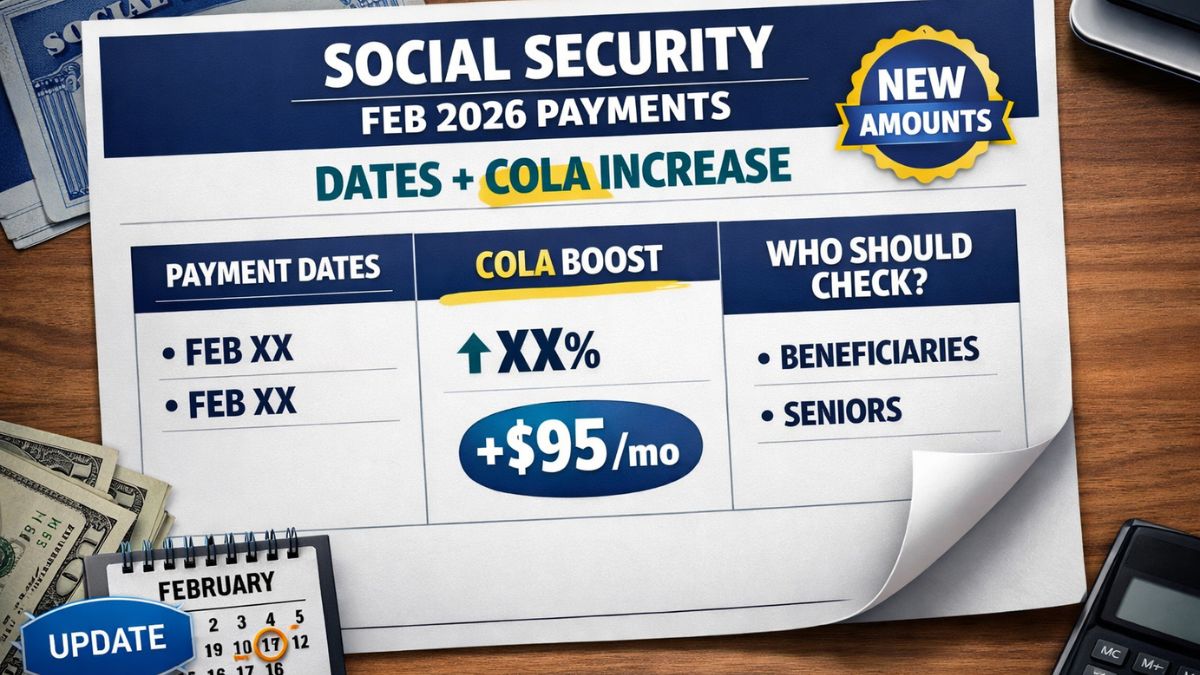

February 2026 Social Security and SSI Payment Dates

For February 2026, some payments will arrive earlier than usual due to how the calendar falls. When the first day of a month lands on a weekend, Supplemental Security Income payments are issued on the last business day before that date. Because February 1, 2026 falls on a Sunday, SSI benefits are scheduled to be paid on Friday, January 30. This early deposit is simply the February benefit paid ahead of time, not an extra payment.

People who receive both SSI and Social Security retirement or disability benefits will receive their Social Security payment on February 3. Other beneficiaries will follow the standard Wednesday birthday schedule. Those with birthdays early in the month will be paid on the second Wednesday. Those with mid-month birthdays will be paid on the third Wednesday. Those born later in the month will receive payment on the fourth Wednesday.

Even when dates shift slightly, the system is designed to keep payments predictable and consistent.

How the 2026 Cost-of-Living Increase Shows Up in February Checks

All February 2026 Social Security payments include the latest cost-of-living adjustment that started with January benefits. This yearly adjustment is applied to help benefits keep pace with rising prices in areas like food, housing, utilities, and healthcare. Without this adjustment, fixed monthly payments would lose buying power over time.

The 2026 adjustment adds a modest percentage increase to benefit amounts. While the raise may not feel dramatic, it still results in more money each month compared with last year. Average retirement benefits are now slightly higher, and maximum benefit levels have also moved up. SSI federal payment standards have increased as well for both individuals and couples.

Because the increase is percentage-based, people with higher base benefits see a larger dollar increase, while those with smaller benefits see a smaller dollar rise. The adjustment is automatic and does not require any application.

Why Even a Modest Increase Makes a Difference

Some beneficiaries feel disappointed when they see that the yearly increase is not very large. However, even a moderate adjustment plays an important role for people living on fixed income. Small monthly increases can help offset higher prescription prices, rising grocery bills, or increased utility costs.

Over a full year, the added amount can cover several essential expenses. The main goal of the adjustment is protection, not profit. It is meant to slow the loss of purchasing power caused by inflation. Financial planners often point out that without these yearly adjustments, long-term beneficiaries would struggle much more with rising living costs.

The adjustment acts like a built-in stabilizer for household budgets that depend heavily on Social Security.

How Beneficiaries Can Plan Around February Payments

Knowing the exact payment schedule and updated benefit amount makes monthly planning easier. Direct deposit remains the safest and fastest payment method. Funds are usually available in bank accounts early on the morning of the scheduled payment date. Paper checks take longer and carry more risk of delivery problems.

It is important for beneficiaries to keep their banking details and mailing addresses current. Outdated information is a common cause of payment delays. If a deposit does not appear on the expected date, it is generally recommended to allow a few business days before reporting a missing payment, since bank processing times can vary.

Reviewing benefit statements and online accounts regularly also helps people catch and fix problems quickly.

Clearing Up Common February Payment Myths

Several myths appear every year about February Social Security payments. Some claim the amount is smaller because the month is shorter. Others believe early deposits mean bonus payments. Neither is true. Benefit amounts stay the same, and early deposits simply prevent delays caused by weekends or holidays.

The Social Security system follows fixed rules and schedules. Once people understand these rules, much of the yearly February anxiety disappears. Reliable information is one of the best tools for reducing financial stress.

Disclaimer

This article is for informational purposes only and is written in simple language for general understanding. Social Security payment dates, benefit amounts, and cost-of-living adjustments may change based on official government decisions and individual records. This content is not financial, legal, or retirement advice. Readers should consult official Social Security sources or a qualified professional for guidance specific to their personal situation.