The 2026 tax season is getting closer, and millions of taxpayers in the United States are preparing to file their federal income tax returns. One of the biggest questions people ask every year is when their tax refund will arrive. For many households, a refund is not just extra money. It is often used to pay bills, reduce debt, catch up on expenses, or rebuild savings after the holiday season. Because of this, refund timing matters a lot.

Although the IRS does not publish exact refund dates for each person, typical processing patterns from past years help estimate when refunds are usually sent. Understanding how the system works can reduce stress and help taxpayers plan their finances more confidently.

How the Tax Refund Process Starts After Filing

After a taxpayer submits a federal tax return, the processing journey begins. The return first goes through an acceptance stage. Once accepted, the system checks the information provided. This includes reviewing reported income, verifying tax credits, and matching details with employer and third-party records such as W-2 and 1099 forms.

If the numbers and records match and there are no warning flags, the return moves forward smoothly. If something looks incorrect or incomplete, the return may be paused for review. Refunds are only approved after these checks are completed. That is why two people who file on the same day can receive their refunds on different dates.

Accuracy plays a major role here. Even small mistakes can slow down approval and delay payment.

Why Filing Method Makes a Big Difference

The way a return is filed has a strong impact on refund speed. Electronic filing is much faster than mailing a paper return. When a return is filed online, it goes directly into the IRS processing system. This reduces manual work and lowers the chance of data entry errors.

Paper returns must be opened, sorted, and entered by hand. This adds time and can create delays, especially during busy periods. Paper filings are also more likely to have missing information or signature issues, which can trigger additional review.

Taxpayers who want faster refunds usually benefit from filing electronically. It is now the most commonly used method and generally the most efficient.

Choosing Direct Deposit Speeds Up Delivery

How you choose to receive your refund is just as important as how you file. Direct deposit is usually the fastest way to get paid. When direct deposit is selected, the refund is transferred straight into a bank account once approved.

Paper checks take longer because they must be printed and mailed. Delivery time depends on postal speed and address accuracy. There is also a small risk of checks being delayed or lost in transit.

Direct deposit reduces these risks and often cuts days or even weeks off the total waiting time. That is why most tax professionals recommend it as the preferred refund method.

Expected Opening Window for the 2026 Season

Based on recent yearly patterns, the IRS is expected to begin accepting 2025 tax year returns in late January 2026, likely around the last week of the month. Once filing opens, early filers who submit clean electronic returns with direct deposit often receive refunds within about three weeks.

Some simple returns may move faster and be completed in around two weeks, but this is not guaranteed. Processing time depends on volume, accuracy, and whether extra verification is required. Early filing does not guarantee instant payment, but it usually places a return earlier in the processing line.

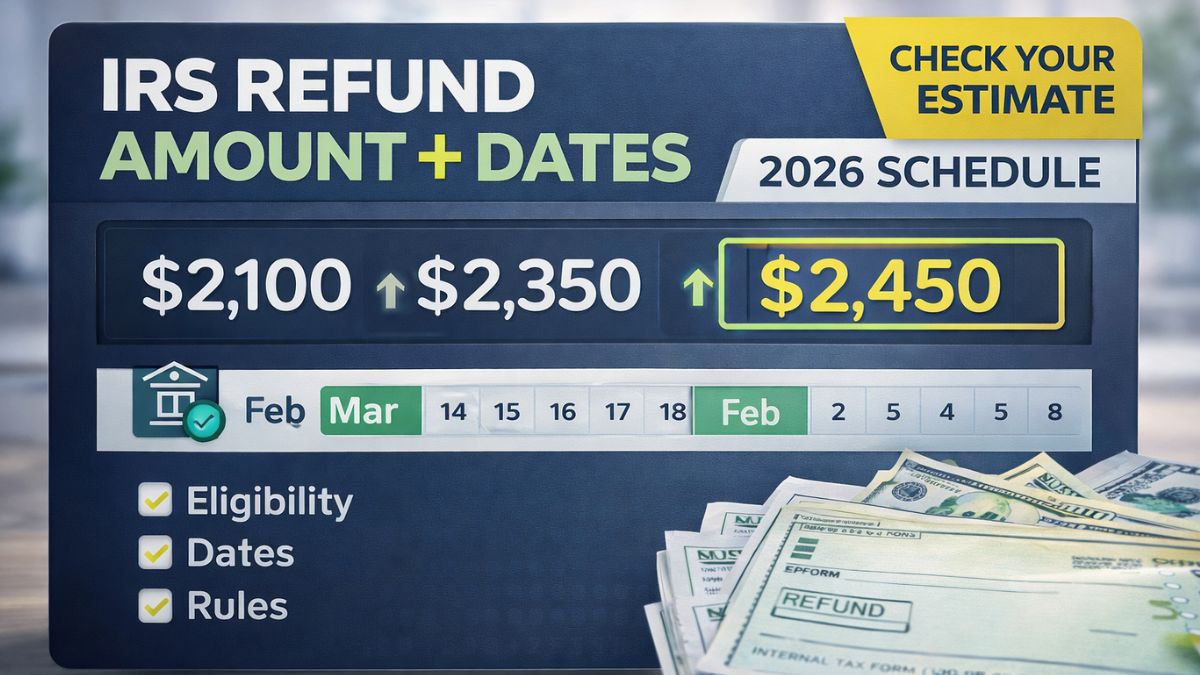

Estimated Refund Timing Based on Filing Date

Taxpayers who file electronically in the first days after the system opens often see refunds arrive in mid to late February if there are no issues. Those who file in early February commonly receive refunds toward late February or early March.

Returns filed later in February or March typically produce refunds in March or April. These are only general timing patterns, not promises. Each return is handled individually, and processing speed can change depending on workload and review needs.

People should avoid making major financial commitments based only on an estimated refund date.

Special Credits Can Delay Refund Release

Some refunds are legally delayed because of special credit rules. Returns that claim the Earned Income Tax Credit or the Additional Child Tax Credit usually cannot be fully released until at least mid-February. This rule exists to reduce fraud and prevent incorrect payments.

Even if these returns are filed very early, the refund may still be held until the review window passes. After that point, processing continues and payments are scheduled.

Other factors can also cause delays. Identity verification requests, mismatched income records, missing forms, or suspected errors can move a return into manual review. When the IRS sends a notice, responding quickly helps prevent longer delays.

How to Check Your Refund Status Safely

Taxpayers can follow their refund progress using the official IRS refund tracking tool or their secure online tax account. These tools show simple status stages such as received, approved, and sent. Updates usually appear within a day after e-filing and change as processing moves forward.

Checking official tools is the safest way to get accurate information. Third-party refund calendars and social media posts often provide only rough guesses. Each refund is based on individual return details, so general charts cannot predict exact payment dates.

It is also important not to submit duplicate returns while waiting. Sending the same return twice can create confusion and slow processing.

What Most Taxpayers Should Expect in 2026

Most refunds in the 2026 season are expected to be issued between February and April, depending on when the return is filed and whether any reviews are required. People who file early, use electronic filing, choose direct deposit, and double-check their information usually experience the fastest turnaround.

There is no universal refund calendar that fits everyone. Still, knowing the normal processing flow helps set realistic expectations. Careful filing and patience remain the best approach.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. IRS refund timelines can change based on processing conditions, verification requirements, and individual tax situations. Taxpayers should rely on official IRS resources or consult a qualified tax professional for accurate and personalized guidance.