The 2026 tax filing season is approaching, and many people across the United States are already thinking about their IRS tax refunds. For millions of taxpayers, a refund is not just extra money. It often helps cover important expenses such as rent, bills, debt payments, and savings. Because of this, understanding when refunds may arrive and how the system works can help families plan better.

The IRS is expected to begin accepting tax returns for the 2025 tax year in late January 2026. While exact refund deposit dates are never officially guaranteed in advance, past processing patterns give a reasonable idea of when taxpayers might receive their money. Filing early, submitting accurate information, and choosing direct deposit are still the most important factors for getting refunds faster.

When the 2026 Tax Filing Season Is Expected to Start

The IRS usually opens the tax filing season toward the end of January. For the 2026 season, the expected opening window is around the last week of January. Returns submitted before the official opening are held in queue and are not processed until systems go live. That means sending a return too early does not speed up the refund.

The standard filing deadline is expected to remain April 15, 2026. Taxpayers who need more time can request an extension, but an extension only gives more time to file paperwork, not more time to pay any taxes owed. Refund seekers are generally encouraged to file as early as they reasonably can once the window opens.

How IRS Refund Processing Works Step by Step

After a tax return is submitted, it goes through several review stages. First, the IRS system checks personal details such as Social Security numbers and names. Then it compares income data with employer and bank reports. Credits and deductions are also checked against eligibility rules.

Although IRS technology has improved, not every return is handled fully by automation. Some returns are flagged for manual review if something looks inconsistent or incomplete. Even small errors, like a wrong account number or missing form, can move a return out of the fast processing path and cause delays.

Electronic filing is now the main method used by taxpayers. Most returns are filed online through tax software or tax professionals. E-filed returns with direct deposit details are typically processed much faster than paper returns sent by mail. Paper filings can take several extra weeks because they must be opened, sorted, and entered manually.

Estimated IRS Refund Deposit Timeline for Early Filers

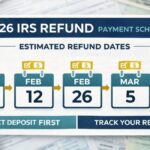

Based on prior year trends, taxpayers who file electronically in the first week after the IRS opens and whose returns are error-free often receive refunds within about two to three weeks. That places many early filers in a mid-February refund window.

Returns filed from late January through the first days of February are usually processed in the first major batches. Many of these refunds are commonly deposited between the second and third week of February, assuming there are no verification issues.

As more returns arrive, system volume increases. That can slightly slow processing times for people who file later in February and March. Even then, many electronic filers still receive refunds within roughly 21 days.

Special Refund Delays for Certain Tax Credits

Not all refunds follow the same timeline. Returns that include certain refundable credits face extra review by law. Two of the most common are the Earned Income Tax Credit and the Additional Child Tax Credit.

Because of anti-fraud rules, the IRS holds these refunds for additional checks each year. Even if the return is filed early, refunds that include these credits are usually not released until the second half of February at the earliest. In many past years, these deposits began appearing near the end of February.

This delay is normal and does not mean there is a problem with the return. It is simply part of the required verification process tied to these credits.

Common Reasons Why Refunds Get Delayed

Refund delays usually happen for specific and correctable reasons. Mistakes in reported income, mismatched names or Social Security numbers, and missing tax forms are among the most frequent causes. When data does not match what employers or banks reported, the system often pauses the return for review.

Identity verification is another growing factor. If the IRS suspects possible identity theft or fraud, it may ask the taxpayer to confirm their identity before releasing the refund. While this can be frustrating, it is meant to prevent criminals from stealing refunds.

Incorrect bank details can also cause problems. If a direct deposit fails because of a wrong account or routing number, the refund may be converted to a paper check, adding more time to delivery.

Direct Deposit vs Paper Check Timing

Direct deposit remains the fastest way to receive a tax refund. When bank details are entered correctly, funds are transferred electronically as soon as the refund is approved. Many taxpayers receive deposits days or even weeks sooner compared to mailed checks.

Paper checks take longer because they must be printed and sent through the mail. Delivery times vary by location and postal workload. It is common for mailed refunds to take several additional weeks beyond the processing date.

Because of speed and security, direct deposit is strongly preferred by tax professionals for the 2026 season.

How Refund Timing Affects Household Budgets

Tax refunds play an important role in many household budgets. Some families use refunds to catch up on overdue bills. Others reduce credit card balances or set aside emergency savings. When refunds are delayed, people may need to rely on short-term borrowing or postpone necessary payments.

Having a general expectation of refund timing helps with planning. While exact dates cannot be promised, knowing the typical two-to-three-week processing window for e-filed returns gives taxpayers a reasonable estimate for budgeting purposes.

How to Track Your IRS Refund Status

Taxpayers can track their refund using the official IRS refund tracking tool available online. Status updates usually appear within a day after e-filing and within several weeks for mailed returns. The tool shows when the return is received, approved, and when the refund is sent.

Checking refund status online is more reliable than calling, especially during peak filing season when phone lines are busy. Keeping a copy of the filed return makes it easier to enter the required tracking details.

What Taxpayers Should Do to Get Refunds Faster

Filing electronically, double-checking all entries, attaching required forms, and choosing direct deposit are the most effective ways to avoid delays. Responding quickly to any IRS verification requests also helps keep refunds moving.

Preparing documents early and filing soon after the season opens can place a return in the earlier processing waves, which often leads to earlier deposits.

Disclaimer

This article is for general informational purposes only. It is based on typical IRS procedures, historical refund timelines, and standard processing patterns. Actual refund dates and amounts can vary depending on individual tax situations, filing accuracy, verification checks, and IRS system workload. Taxpayers should always refer to official IRS resources or consult a qualified tax professional for the most accurate and up-to-date guidance before making financial decisions.