The IRS has confirmed that federal income tax refunds will begin going out during February, giving millions of Americans a clearer idea of when they may receive their money. This update is important for taxpayers who filed early and are waiting for their refunds to cover bills, reduce debt, or support their household budgets. Every year, refund timing becomes a major topic because many families depend on this payment as part of their financial planning.

After weeks of questions and online speculation, the confirmation that February refunds are rolling out brings more certainty. While not every taxpayer will be paid on the same date, the general processing window is now clearer. Understanding how the refund system works can help people set realistic expectations and avoid confusion.

Why February Refund Timing Matters So Much

For many households, a tax refund is one of the largest single payments they receive all year outside of regular income. Some people use it to catch up on rent or mortgage payments. Others use it to pay medical bills, repair vehicles, or rebuild emergency savings. Because of this, even small changes in refund timing can affect financial decisions.

February is usually the first major refund month of the tax season. Early filers who submit returns as soon as electronic filing opens are often processed first. That is why so much attention is placed on February deposit dates. When refunds start arriving, it also creates a ripple effect in local economies as spending increases.

How the IRS Refund Process Works Behind the Scenes

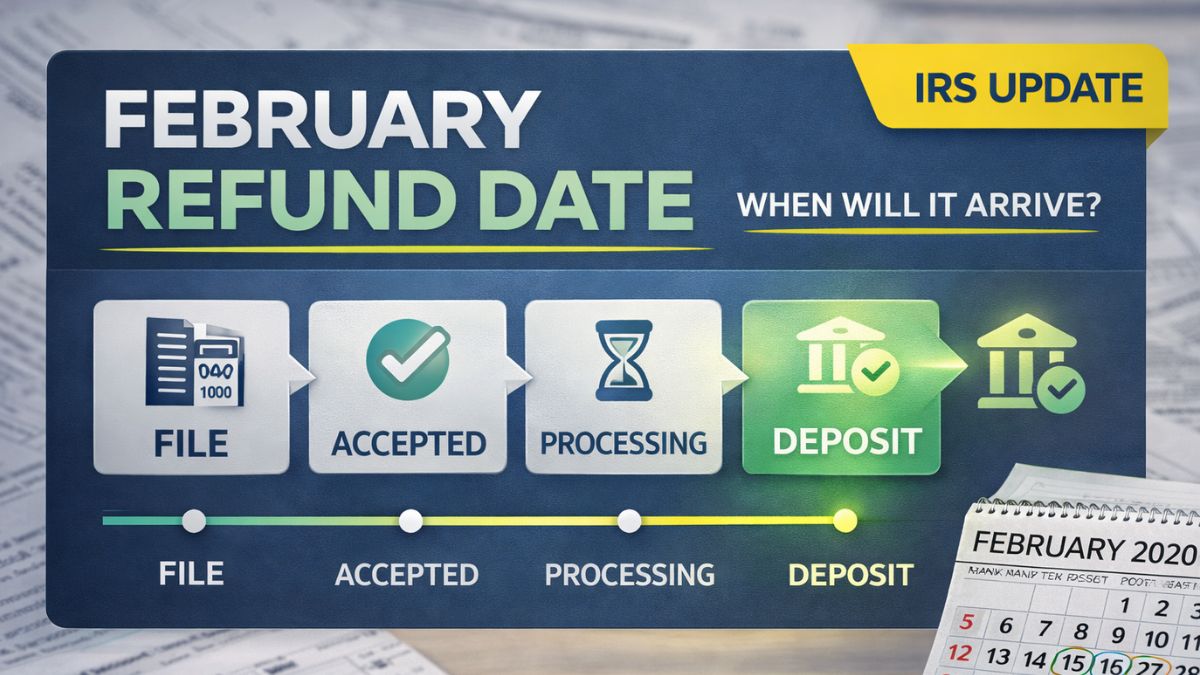

After a tax return is submitted and accepted, it goes through several review steps. IRS systems check reported income, withholding amounts, and claimed credits. The information is compared with records received from employers and financial institutions. If everything matches and no errors are found, the refund moves toward approval.

If something does not match or appears incomplete, the return may be flagged for additional review. This does not always mean there is a serious problem, but it does add time. Only after all required checks are completed is the refund scheduled for payment.

Because each return is different, processing speed can vary from person to person even if they file on the same day.

Who Is Most Likely to Receive Refunds First

Taxpayers who file electronically and choose direct deposit usually receive refunds the fastest. Digital filing sends the return straight into the IRS processing system, reducing manual handling. Direct deposit sends the money straight to a bank account once approved, avoiding mail delays.

Early filers with simple, accurate returns often appear in the first wave of February payments. Returns with complete information and no calculation errors tend to move through automated checks more smoothly.

People who mail paper returns generally wait longer. Paper filings must be opened and entered manually, which adds processing time, especially during busy periods.

Typical February Refund Timeframes

Most electronically filed returns with direct deposit are commonly processed within about 10 to 21 days after acceptance. Some simple returns may be completed sooner, but that is not guaranteed. The confirmed February rollout means many early filers should see deposits during the month, though exact dates differ.

Paper returns can take several weeks longer due to manual processing and mailing time. Bank posting times can also add a small delay after the IRS sends the payment.

It is important to remember that these are estimated timelines, not fixed promises. Processing volume and verification needs can change the pace.

Why Some Refunds Take Longer Than Others

Not all refunds move at the same speed. Some are delayed due to incorrect personal details, missing income forms, or math mistakes. If a Social Security number, name, or bank detail does not match official records, the system may pause the return.

Identity verification reviews are another common reason for delay. If the IRS needs confirmation, they will send a notice with instructions. Responding quickly helps move the process forward.

Returns that claim certain tax credits may also face extra review steps required by law. These checks are designed to prevent fraud and incorrect payments. While they add time, they are part of normal procedure.

How to Track Your Refund Status Properly

Taxpayers can check their refund progress using official IRS tracking tools. These tools show whether a return has been received, approved, or sent for payment. Updates usually appear within about a day after an electronic return is accepted and then change as the return moves through stages.

To check status, taxpayers typically need their Social Security number, filing status, and expected refund amount. Entering exact numbers matters for the system to show results correctly.

Official tracking tools are more reliable than social media posts or unofficial refund calendars. General schedules can provide rough guidance, but only the official tracker reflects an individual return.

IRS Efforts to Speed Up Refund Processing

The IRS has continued upgrading its digital systems to improve processing speed and reduce backlogs. Expanded electronic filing support, better data matching, and automation have helped many straightforward returns move faster than in past years.

These improvements are aimed at reducing errors and delivering refunds more efficiently. Even so, high filing volume during peak weeks can still create slowdowns. Technology helps, but careful and accurate filing by taxpayers is still essential.

Practical Steps That Help Refunds Arrive Faster

Taxpayers who want the best chance of fast payment usually benefit from filing electronically, choosing direct deposit, and reviewing all entries before submitting. Making sure names, numbers, and bank details are correct prevents avoidable delays.

Filing earlier in the season can also help, since returns enter the processing line sooner. However, accuracy should never be sacrificed just to file quickly.

What Families Can Expect This February

With February refund processing officially underway, many Americans can expect payments to arrive within weeks if their returns are accurate and complete. Early electronic filers using direct deposit are in the strongest position for faster refunds. Others may wait longer depending on filing method and review needs.

Knowing the process and typical timelines helps families plan without relying on rumors or guesswork. Patience and accuracy remain the most reliable approach during tax season.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. Refund timing depends on individual tax details, filing accuracy, and IRS processing conditions. Actual payment dates may vary. Taxpayers should use official IRS tools or consult a qualified tax professional for guidance specific to their situation.