$2000 Federal Direct Deposit for All: In early 2026, many people across the United States are hearing about a possible $2000 federal direct deposit payment. Social media posts and online articles often describe it as a payment for everyone, which has created both hope and confusion. With living costs still high for food, rent, utilities, and healthcare, it is understandable that families are paying close attention to any news about federal financial support. However, it is important to separate confirmed facts from proposals and discussions.

As of now, a $2000 federal direct deposit for all Americans is not an approved or guaranteed payment. It is part of ongoing policy discussions connected to budget planning and economic support ideas. No final law has been passed that authorizes this payment. Understanding the real status helps people avoid false expectations and protects them from misinformation.

Why the $2000 Federal Payment Idea Is Being Discussed

The idea of sending a one-time $2000 payment comes from continued financial pressure on households. Even though some wages have increased, many everyday expenses have risen faster. Families are spending more on groceries, housing, insurance, and medical care than they did a few years ago.

Some policymakers believe that a direct cash payment is one of the fastest ways to provide relief. Instead of creating complex programs with long applications, a direct deposit can reach people quickly using existing government payment systems. Supporters say this method is simple and gives households freedom to use the money where they need it most.

This is why the proposal keeps appearing in federal discussions. It is seen by supporters as a quick-response economic tool during periods of cost pressure.

The Ongoing Policy Debate Around Direct Payments

There is not complete agreement among lawmakers about broad direct payments. Those in favor argue that a one-time payment can reduce short-term financial stress and help stabilize household budgets. They also say that when people spend that money, it supports local businesses and communities.

Those who oppose the idea raise concerns about government spending levels and national debt. Some also worry that very broad payments can add inflation pressure if too much money enters the economy at once. Others believe that any financial help should be more targeted toward lower-income households instead of being universal.

Because of these differences, the proposal remains under debate rather than approved.

Current Status of the $2000 Payment in February 2026

Right now, the $2000 federal direct deposit remains a proposal, not a law. For such a payment to happen, it must pass through Congress in the form of legislation and then be signed by the President. Only after that would federal agencies receive authority to send funds.

If approved, departments responsible for distribution would likely include the Treasury and tax authorities, along with benefit agencies for retirees and disability recipients. Until a bill is officially passed, no payment schedule can be confirmed.

This means people should treat any message claiming the payment is already approved as incorrect.

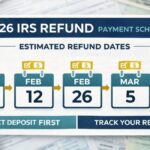

Why February 2026 Is Mentioned in Payment Discussions

February 2026 is often mentioned in online discussions because it aligns with tax season and federal payment system activity. During tax season, government systems that handle refunds and benefit deposits are already running at full capacity. That makes it technically easier to send out payments if a law is passed early in the year.

However, this timing is only a possibility, not a confirmed schedule. If legislation were approved later, any payments would move to a later date. The mention of February should be seen as a potential window, not a promise.

Possible Eligibility Rules If the Plan Is Approved

Eligibility rules are one of the biggest unknowns. Some versions of the proposal describe a universal payment, while others suggest income limits. In many draft concepts, recipients would need to be U.S. residents with a valid identification number and recent tax or benefit records on file.

Working taxpayers, retirees, and people receiving disability or income-support benefits are often included in draft outlines. But final eligibility would depend completely on the wording of the law that gets passed.

Until that happens, no one can say with certainty who would qualify.

How Income Limits Could Affect Payment Amounts

Some proposals follow earlier relief payment models where income level affects how much a person receives. Under that structure, lower- and middle-income households receive the full amount, while higher-income earners receive a reduced payment or none at all.

Income thresholds usually differ by filing status, such as single, married, or head of household. These numbers are still part of discussion drafts and are not official. Only enacted legislation would lock in the real limits.

Because of this, people should be cautious about charts and tables circulating online that claim to show final eligibility cutoffs.

How Funds Would Likely Be Delivered

If a $2000 payment were approved, distribution would likely use existing federal payment channels. Direct deposit would be the fastest method. Bank account details already on file from tax returns or benefit programs would be used first.

People without bank details on file might receive a mailed check or a prepaid debit card. This is similar to how past federal relief payments were delivered. Direct deposit usually arrives first, while mailed payments take longer due to printing and postal delivery time.

No application would likely be required for most eligible people, since eligibility would be determined from existing records.

Tax Impact of a Possible $2000 Payment

Many proposals describe the payment as non-taxable, meaning it would not count as regular income on a tax return. Under that approach, it would not reduce a person’s refund or increase their tax bill.

It also would likely be excluded from calculations for most federal benefit programs, at least for a defined period. Final tax treatment would be clearly written in the law and followed by official guidance.

Until a law exists, though, tax treatment remains theoretical.

Scam Risks and Misinformation Warnings

Whenever payment rumors spread, scams increase. Messages that say a $2000 payment is guaranteed right now are misleading. Any request asking for fees, passwords, or personal data to “release” the payment is a red flag.

Government agencies do not charge fees to receive federal payments and do not ask for sensitive details through random texts or emails. Official updates come through government announcements and established news sources.

Being patient and verifying sources is the best protection.

Final Perspective on the $2000 Direct Deposit Talk

The proposed $2000 federal direct deposit has gained attention because many families are under financial strain. The idea is being discussed seriously in policy circles, but it is not approved or scheduled. No payment is guaranteed at this time.

People should stay informed but cautious. If approved, details about timing, eligibility, and delivery would be clearly announced through official channels. Until then, it remains a proposal, not a promise.

Disclaimer

This article is for informational purposes only and does not confirm or guarantee any federal payment. Program rules, eligibility conditions, and timelines may change based on legislative action and government decisions. This content is not financial or tax advice. Readers should rely only on official government announcements and consult qualified professionals for guidance related to their personal situation.