IRS Filing Timeline 2026 Confirmed: The 2026 tax filing season is expected to follow a more structured and deadline-driven timeline than many taxpayers are used to. The Internal Revenue Service is putting stronger focus on filing dates, processing order, and verification steps. While this may sound like an internal administrative change, it directly affects when people receive their refunds and how long problem cases take to resolve. In practical terms, timing and accuracy will work together in determining how smooth a taxpayer’s experience will be.

Many households depend on their tax refund as part of their yearly financial plan. That makes it important to understand how the filing calendar works and why the late-February refund window, especially around February 28, is considered a key processing period for many early filers.

Why Refund Timing Is Especially Important in 2026

For a large number of Americans, a tax refund is not just extra cash. It is often used to catch up on bills, reduce debt, handle car repairs, or rebuild savings after the holiday season. Because of this, even a short delay can disrupt monthly budgets.

In 2026, the IRS is emphasizing that refund timing depends heavily on when and how a return is filed. Electronic returns with correct information and direct deposit details move faster through the system. Returns with errors, missing data, or identity questions move more slowly. The difference between filing early and filing late could mean a gap of several weeks or more in receiving money.

The processing system works in cycles. Returns are grouped and reviewed in batches. That means your place in line is influenced by your filing date and whether your return passes automated checks.

When the 2026 Tax Filing Season Opens and Closes

The filing season is expected to open in the last week of January 2026. From that point forward, the IRS begins accepting and processing returns. The standard filing deadline is expected to remain in mid-April. While extensions are available, they mainly give more time to submit paperwork, not more time to delay payment if taxes are owed.

The IRS has signaled that late-season flexibility will be limited. As the deadline approaches, processing centers are under heavier workload. This makes corrections and verifications slower. Filing near the cutoff date leaves less time to fix mistakes or respond to notices before penalties or delays begin.

Understanding the February 28 Refund Impact Window

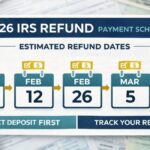

For early filers, the period around the last week of February — including the February 28 timeframe — is often when the first large wave of refunds appears. Historically, taxpayers who file electronically soon after the season opens and whose returns are error-free often receive refunds within two to three weeks. That places many of those deposits in the late-February window.

This timing is especially relevant for people who file in late January or the first days of February. If their income records match IRS data and no special reviews are required, their refunds are commonly approved and released around this period.

However, not every early filer will be paid by then. Returns that include certain refundable credits or that trigger identity or income verification checks may be held longer. So while February 28 is an important benchmark window, it is not a guaranteed payment date for everyone.

Early Filing Compared With Late Filing Results

Filing early in the season generally improves the chances of faster processing. Early returns enter the system before peak volume builds up. Automated checks run faster when fewer returns are in queue. When combined with direct deposit, this often leads to the shortest refund timelines.

Late filers face a different situation. By March and April, the IRS is handling very high submission volumes. More returns are flagged for manual review simply due to data mismatches or missing attachments. Even simple corrections can take longer because staff workload is higher.

As a result, two taxpayers with similar returns could receive refunds weeks apart purely because one filed early and the other waited until close to the deadline.

Financial Risks of Waiting Until the Deadline

Waiting too long to file increases more than just refund delays. It also increases financial risk. If a return contains an error, there may be little time left to correct it before the deadline passes. If taxes are owed, interest and penalties can begin accumulating quickly after the due date.

Identity verification requests are another factor. When the IRS asks for identity confirmation, processing stops until the taxpayer responds. If that request comes close to the deadline, resolution may stretch well into late spring.

A tighter calendar means fewer safety margins. Filing earlier gives more room to handle unexpected notices without added stress.

How Early Filing Helps With Budget Planning

Many families face higher expenses in late winter. Heating bills, insurance payments, and post-holiday balances often come due around the same time. Knowing that a refund is likely to arrive by late February or early March can make budgeting easier.

Early filing places a return nearer the front of the processing flow. That improves predictability, even though exact deposit dates are never promised. Having a reasonable expectation window helps households avoid relying on credit cards or short-term loans.

Reducing uncertainty is one of the biggest advantages of filing early and filing accurately.

Accuracy and Electronic Filing Matter More Than Ever

While timing is important, accuracy remains critical. The IRS uses automated systems to compare reported income with employer and bank records. Name mismatches, incorrect numbers, and missing forms can all trigger review. Even small typing mistakes can move a return into a slower path.

Electronic filing reduces many of these risks because software checks for common errors before submission. Choosing direct deposit also removes mailing delays and lowers the chance of payment problems.

Together, e-filing and accurate data entry are still the strongest tools taxpayers have to speed up refunds.

Final Thoughts on the 2026 Filing Timeline

The 2026 tax season places more weight on schedule awareness and preparation. The late-February refund window, including the February 28 period, will likely be a key payout time for many early and accurate filers. Those who delay may still receive refunds, but often with longer waits and higher uncertainty.

Preparing documents early, verifying income records, and filing electronically can make the process smoother. In this filing season, planning ahead is not just helpful — it is practical financial strategy.

Disclaimer

This article is for informational purposes only. Filing dates, refund timelines, and IRS processing procedures may change based on official updates and individual tax situations. This content is not tax or financial advice. Readers should check official IRS guidance or consult a qualified tax professional before making filing or refund-related decisions.