$2000 Direct Deposits Starting February 9: As the 2026 tax filing season gets closer, many Americans are hearing repeated talk about $2,000 direct deposits arriving as early as February 9. This has created both excitement and confusion. For many families, a tax refund is not just routine paperwork — it is an important source of financial relief used for rent, bills, medical costs, and debt payments. But it is important to understand what this $2,000 figure actually represents and how refund timing really works.

There is no universal $2,000 payment being sent to everyone. Instead, this number reflects a common refund range that many taxpayers have received in past years. The actual amount and date depend on each person’s tax return, filing method, credits claimed, and whether the return passes verification checks smoothly.

Why Early February Refund Dates Are Being Discussed

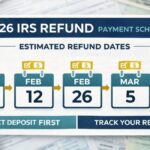

Every year, the tax agency typically begins accepting returns toward the end of January. Once processing starts, electronically filed returns with direct deposit selected are usually handled first. Because of this pattern, some early filers often receive refunds within a few weeks. That is why early February dates — including around February 9 — are often mentioned in refund discussions.

This is based on historical processing speed, not on a guaranteed payout schedule. When the system runs normally and a return is simple and error-free, refunds can move quickly. However, if there are system backlogs, verification flags, or missing information, the timeline can easily shift later.

For households under financial pressure, even a one- or two-week difference matters. That is why so much attention is placed on the earliest possible deposit window.

How the 2026 Tax Filing Season Is Expected to Work

The upcoming filing season is expected to follow the same general structure as recent years. Tax returns will begin flowing into the system in late January. Digital submissions will move faster because they can be checked automatically against employer wage reports and bank data. Paper returns will take longer because they must be opened, sorted, and entered manually before processing even begins.

System upgrades and administrative improvements in recent years have helped reduce some delays. Even so, volume remains very high during the first few weeks of filing season. When millions of people submit returns at the same time, processing speed can vary from day to day.

Tax professionals generally expect that early filers with straightforward returns could start seeing refunds in early to mid-February, assuming no review issues appear.

Why E-Filing and Direct Deposit Make a Big Difference

The method you choose to file your taxes has a major effect on how fast your refund arrives. Electronic filing sends your return directly into the processing system. This removes mailing time and manual data entry delays. It also reduces common errors because tax software checks for missing fields and calculation mistakes before submission.

Direct deposit speeds things up even more. When a refund is approved, the money is transferred straight to your bank account. This avoids check printing and postal delivery time. It also lowers the risk of a check being lost or stolen.

When taxpayers use both e-filing and direct deposit together, they usually receive refunds much faster than those who file on paper and request mailed checks. In some cases, this can mean the difference between a February refund and a March refund.

Understanding Where the $2,000 Refund Number Comes From

The $2,000 figure appears often in tax season conversations because it is close to the average refund amount many working households have received in recent years. This happens due to payroll withholding patterns, standard deductions, and refundable tax credits. But it is not a promised amount and should not be treated as guaranteed.

Refunds are calculated based on how much tax you paid during the year compared to how much you actually owed. If too much was withheld from your paychecks, you receive the difference back. Credits for children, education, or low-to-moderate income can increase refunds further.

Because every tax situation is different, refund amounts vary widely. Some people receive a few hundred dollars, others receive several thousand, and some receive nothing or may even owe additional tax. The $2,000 number is a common outcome, not a standard payment.

Tax Credits and Verification Checks Can Slow Refunds

Not every refund moves through the system at the same speed. Returns that include certain refundable credits often require extra review by law. These include credits designed to support working families and parents. Because these credits have been targets of fraud in the past, additional verification steps are required before refunds are released.

Identity and income verification is another common cause of delay. If reported income does not match employer records, or if duplicate claims appear, the return may be paused for review. Sometimes the agency sends a notice asking for confirmation or documents. Quick responses help reduce the delay, but the review still adds time.

Even small data mismatches can trigger a manual check. Accuracy when filing is one of the best ways to avoid these slowdowns.

Why Refund Season Matters for Household Budgets

For many families, tax refunds act like a yearly financial reset. The money is often used to catch up on overdue bills, repair vehicles, pay medical expenses, or rebuild savings. Because everyday living costs remain high, the timing of refunds is especially important.

Economists also observe that refund season increases short-term consumer spending. When refunds arrive, purchases of household goods, services, and repairs often rise. This creates a temporary boost in local economic activity. Even though refunds are not new income — just returned overpayments — their arrival timing affects real-world financial behavior.

What Taxpayers Should Expect as February Gets Closer

As the filing window opens, there is usually a surge of early submissions from people hoping to receive faster refunds. If processing systems run smoothly, the first wave of approved refunds may begin reaching bank accounts in early February. However, exact dates cannot be guaranteed for everyone.

Processing speed depends on filing accuracy, credit claims, verification checks, and overall return volume. The most reliable way to track progress is through the official refund tracking tool provided by the tax authority, which shows real-time status updates once a return is accepted.

Planning ahead, filing accurately, and choosing electronic methods remain the strongest steps taxpayers can take to receive refunds as quickly as possible.

Disclaimer

This article is for general informational purposes only and is written in simple language for basic understanding. Refund amounts and payment dates are not guaranteed and depend on individual tax details, filing accuracy, verification checks, and administrative processing conditions. This content does not constitute tax, legal, or financial advice. Readers should consult official government resources or a qualified tax professional for guidance specific to their situation.