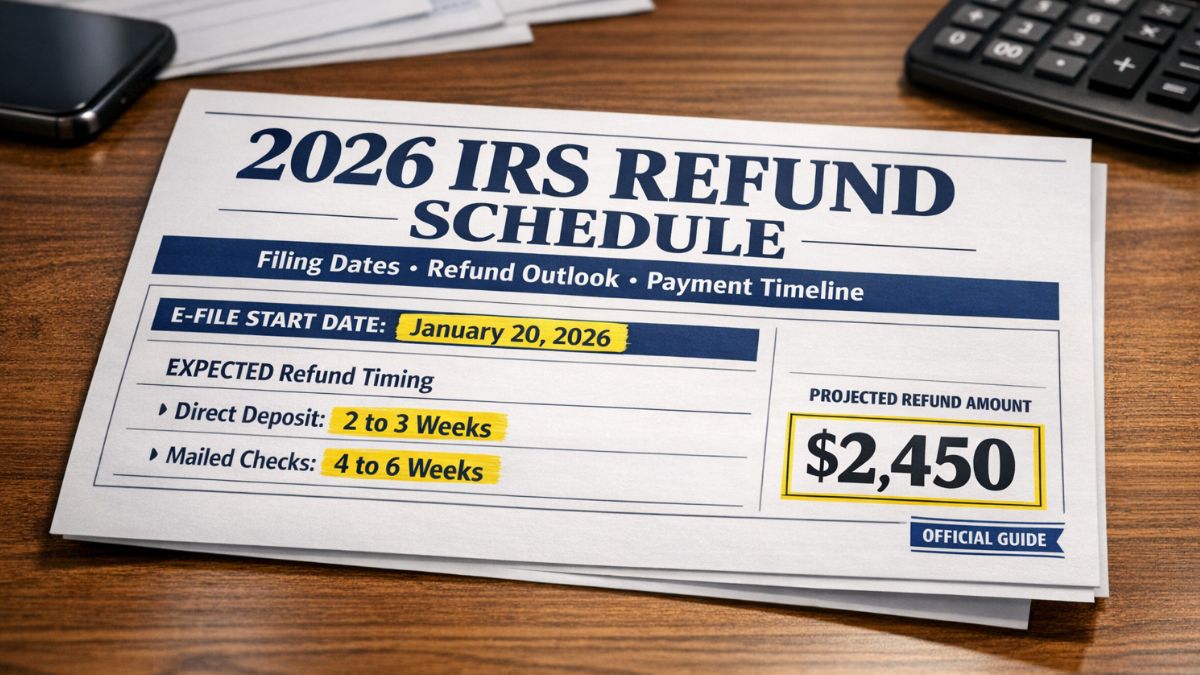

2026 IRS Tax Refund Schedule Explained: The 2026 IRS tax refund season is expected to follow a pattern similar to previous years, but many taxpayers still feel confused about when they will receive their refunds. Knowing how the process works can help reduce stress and set realistic expectations. The Internal Revenue Service generally begins accepting tax returns for the previous tax year toward the end of January. For the 2026 season, this means returns for the 2025 tax year will likely start being processed in the last week of January 2026. Sending your return before the system opens does not make your refund come faster, because the IRS cannot begin processing until the official start date.

When Filing Opens and the Final Deadline

Most taxpayers can expect the filing window to open in late January and remain open until April 15, 2026. This April date is the standard federal tax deadline unless changed by special circumstances. People who are not ready by the deadline can request an extension, which gives extra time to file the paperwork. However, an extension to file is not an extension to pay. If taxes are owed, the estimated amount should still be paid by the April deadline to avoid penalties and interest. Filing early is often helpful because it gives more time to fix errors and reduces the chance of someone else using your identity to file a fake return.

Why Refund Dates Are Not Fixed for Everyone

Many people look for a refund calendar that shows exact payment dates, but refunds do not work on a fixed public schedule. Each tax return is processed individually. The time it takes depends on how the return is filed, how accurate the information is, and whether extra review is required. Taxpayers who file electronically and choose direct deposit usually receive their refunds the fastest. In many cases, refunds are issued within about 21 days after the IRS accepts the return. Paper returns move more slowly because they must be opened, sorted, and entered manually. This can add several weeks or even months to the processing time.

How Filing Method Affects Refund Speed

The method you choose to file your tax return plays a big role in how quickly your refund arrives. E-filing is the fastest and most efficient option because the data goes directly into IRS systems. Direct deposit is also faster than receiving a paper check by mail. When refunds are mailed, delivery time depends on postal service speed and correct address details. Even small mistakes in bank account or routing numbers can cause delays or rejected deposits. Double checking these details before submitting your return can prevent unnecessary problems.

Refund Delays Related to Tax Credits

Some refunds take longer because they include certain tax credits that require extra review. Returns claiming the Earned Income Tax Credit or the Additional Child Tax Credit are commonly held until at least mid-February. This delay is required by law and is meant to reduce fraud and identity theft. Even if you file on the first possible day, the IRS cannot release these refunds before the hold period ends. After the hold is lifted, processing continues and refunds are issued. Taxpayers claiming these credits should expect a later refund date compared to those who are not claiming them.

Common Reasons Refunds Get Delayed

Refunds can also be delayed for several other reasons. Incorrect Social Security numbers, mismatched income records, missing forms, or calculation errors can all slow down processing. If employer or bank reports do not match the numbers on your return, the IRS may pause processing to review the difference. Returns selected for manual review also take longer. In some cases, the IRS may send a letter asking for identity verification or additional documents. Responding quickly to any IRS notice helps avoid longer delays.

How to Track Your Refund Status

Taxpayers can track their refund progress using the IRS online refund tracking tool called “Where’s My Refund?” This tool updates once per day and shows three main stages: return received, refund approved, and refund sent. Status information usually becomes available within 24 hours after e-filing or several weeks after mailing a paper return. Once the tool shows that a refund has been sent, it may still take one or two business days for the bank to post the deposit. Checking the tool regularly is better than guessing or relying on rumors from unofficial sources.

Is Filing Early in 2026 a Smart Move

Filing early has several advantages, but it must be done carefully. Early filing can reduce the risk of tax identity theft because criminals sometimes try to file fake returns using stolen personal information. Filing before peak season can also mean faster processing because IRS systems are less crowded. However, filing too early without all necessary forms can lead to mistakes. If income documents or tax statements are missing, it is better to wait than to file an incorrect return that needs an amendment later. Accuracy is more important than speed when it comes to tax refunds.

What to Expect From the 2026 Refund Season

The 2026 refund season is expected to show steady processing performance, similar to recent years. The IRS continues to improve its systems, but delays can still happen due to fraud checks, staffing limits, and high return volumes. Most taxpayers who file electronically with correct information and direct deposit should still receive refunds within about three weeks of acceptance. Others may need to wait longer depending on their situation. Refund timing should always be treated as an estimate, not a guarantee.

Steps That Help Ensure a Smooth Refund Process

A smooth refund experience depends on careful preparation. Make sure personal details match official records. Report income exactly as shown on tax documents. Review bank information closely before submitting. Choose electronic filing and direct deposit whenever possible. Keep copies of all forms and confirmation messages. Staying informed through official IRS tools and announcements is the best way to avoid confusion and false expectations.

Final Thoughts on 2026 IRS Refund Timing

The 2026 IRS tax refund schedule follows familiar patterns, but individual timing will always vary. Most electronic filers with direct deposit can expect refunds within 21 days after their returns are accepted, while paper filers and credit claimants may wait longer. Filing early, checking details, and tracking status through official tools are the most reliable ways to manage the process with confidence.

Disclaimer

This article is for informational purposes only. Tax laws and IRS processing timelines can change, and refund timing depends on individual return details. For the most accurate and up-to-date guidance, refer to official IRS resources or consult a qualified tax professional.