As February 2026 begins, many people across the United States are hearing claims about $2000 direct deposits arriving in bank accounts. These conversations are spreading quickly across social media, video platforms, and online forums. For families dealing with higher grocery bills, rent, insurance, and medical costs, the idea of receiving extra federal money sounds encouraging. However, the truth behind these $2000 deposit discussions is more practical than dramatic. Most of these amounts are connected to normal tax refunds and regular benefit payments rather than a brand-new government program.

This article explains where these deposits usually come from, who might receive them, and why they are not universal payments for everyone.

Why February Is a High-Deposit Month

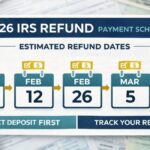

February is always an important month for federal payments because two major money streams often overlap during this time. The first is the income tax refund cycle. The second is the regular monthly schedule for federal benefits. When refunds and benefits arrive close together, the total money received within a short period can look like a single large payment.

People who file their taxes early and choose direct deposit often receive refunds during February. At the same time, monthly benefit payments continue to go out as scheduled. When someone receives both around the same week, the combined amount may be close to or above $2000. This creates the impression that a special payment has been issued, even though it is simply timing.

The Role of Tax Refunds in Larger Deposits

Tax refunds are the most common reason behind deposits near the $2000 level. Refund amounts are different for every taxpayer because they depend on income, tax withholding, and credits claimed. Some workers have more tax withheld during the year than they actually owe. When they file their return, the extra amount is refunded.

Refundable tax credits can increase refunds even more. Credits for working families and parents can raise the final refund total significantly. A household with children may qualify for credits that add thousands of dollars to their refund calculation. When these credits are included, a direct deposit of $2000 or more is not unusual.

Electronic filing and direct deposit also speed up the process. Returns that are filed correctly and accepted quickly are often processed within a few weeks. That is why February becomes a peak period for larger refund deposits.

How Tax Credits Push Refund Totals Higher

Certain tax credits are designed to support low- and moderate-income households and families with children. These credits can sometimes be more valuable than the tax owed, which means the extra amount is paid out as part of the refund. This is one major reason refund deposits can appear surprisingly large.

Parents with qualifying children may receive credits calculated per child. Workers with lower earnings may also qualify for income-based credits. When multiple credits apply on the same return, the combined effect can push the refund total near the $2000 mark or higher. This is not a bonus payment. It is the result of formulas already written into tax law.

Monthly Federal Benefits Also Add to February Totals

Another important factor is monthly federal benefit payments. Retirement benefits, disability benefits, survivor benefits, and veterans benefits are paid on structured monthly calendars. Payment dates are often based on birth dates or program rules.

Because February is a shorter month, payment dates sometimes shift slightly earlier. When that happens, deposits may arrive sooner than people expect. If a household receives more than one type of benefit, the combined monthly support can be substantial. When these benefits arrive around the same time as a tax refund, the total deposits seen in the bank account can look like a single large payout.

Why the $2000 Number Keeps Returning in Rumors

The $2000 figure has strong emotional impact because of past stimulus discussions and round-number relief proposals. Since those events, any deposit near that amount often gets labeled online as a new government payment. In reality, most of these deposits come from standard systems that have existed for years.

When people share bank screenshots without context, others may assume a new program has started. The missing details usually include tax refunds, multiple benefits, or combined household payments. The number spreads faster than the explanation, which leads to confusion.

Reasons Some People Will Not Receive That Amount

Not everyone will receive deposits close to $2000. Refunds and benefits are calculated individually using strict rules. Income level, work history, family size, filing status, and eligibility all matter. Two neighbors can file at the same time and receive very different refund amounts.

There are also cases where expected refunds are reduced before payment. Certain unpaid obligations such as past-due taxes or support payments can be deducted from refunds. When this happens, the final deposit is smaller than the original estimate. This often surprises taxpayers who were expecting a higher number.

Scam Risks Increase During Payment Rumors

Whenever large payment rumors spread, scams increase as well. Fraudsters send messages claiming they can help people claim or speed up a $2000 deposit. They may ask for personal data or charge fake processing fees. These messages often look official but are not.

Real government agencies do not ask for sensitive information through random texts, social media messages, or unofficial emails. They also do not charge fees to release refunds or benefits. The safest approach is to check payment status through official government portals and ignore viral claims that promise guaranteed money.

What February 2026 Really Represents

February 2026 does not mark the launch of a new nationwide stimulus program. Instead, it is a month when tax refunds and benefit payments naturally overlap. Some households will receive deposits near $2000, but those amounts come from existing refund rules and benefit formulas. There is no automatic universal payment attached to this number.

Understanding the difference between routine payments and new relief programs helps families plan better and avoid disappointment. It also reduces the chance of falling for misleading posts or scams.

Final Thoughts

The discussion around $2000 direct deposits in February 2026 is based mostly on timing and existing programs. Early tax refunds, refundable credits, and monthly federal benefits can combine to create larger deposits. These are legitimate payments, but they are not new or guaranteed for everyone. Each amount depends on personal eligibility and calculation rules. Relying on verified sources and official announcements remains the best way to stay informed.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. Payment amounts, eligibility rules, and timelines are determined by official government laws and agency regulations and may change. Individuals should consult official government sources or qualified professionals for guidance related to their specific situation.