The Internal Revenue Service has confirmed that the 2026 tax filing season will follow a more structured and stricter calendar than before. While tax deadlines have always existed, the upcoming schedule places greater importance on timing, accuracy, and early preparation. For many Americans, this is not just a routine update. It can directly affect when refunds are received, how delays are handled, and how financial planning is managed during the first half of the year. Understanding how the 2026 tax calendar works can help taxpayers avoid stress and make better decisions.

Why the 2026 Tax Calendar Is More Important Than Before

For a large number of households, a tax refund is not treated as bonus money. It is often part of the yearly financial plan. Many families use their refund to catch up on bills, reduce debt, pay for repairs, or handle seasonal expenses. Because of this, even a short delay can create real pressure.

The 2026 calendar gives less room for last-minute corrections and late organization. The filing season is expected to begin in late January and close around mid-April, with firm enforcement of deadlines. This means taxpayers who delay gathering documents or submitting returns may face tighter processing timelines and fewer chances to fix mistakes without delays.

The tax calendar is now more closely tied to processing capacity and verification systems. That makes it important for people to prepare earlier than they might have in past years.

Opening and Closing Dates Shape Refund Timing

The opening date of the filing season matters because returns are processed in the order they are accepted. Once the IRS begins accepting returns, electronically filed and correctly completed returns usually move through the system faster. Paper filings and returns with missing information move more slowly.

The mid-April deadline remains the key cutoff point. Returns filed close to that date often arrive in a heavy processing wave. When too many returns arrive at once, review time increases and refund timing becomes less predictable. This is why the calendar itself now plays a bigger role in how quickly taxpayers receive their money.

Submitting earlier in the season spreads out the processing load and gives each return more review attention without backlog pressure.

How Refund Processing Will Work in 2026

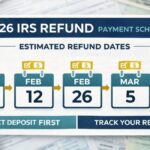

Refunds will continue to be issued in stages rather than all at once. The speed of payment depends on when the return is filed, how accurate it is, and whether it includes items that require additional checks. Returns that claim certain credits or trigger identity verification steps may take longer to review.

Electronic filing combined with direct deposit remains the fastest path to receiving a refund. When returns are submitted digitally and banking information is correct, processing is usually quicker. Errors in account numbers or personal details can slow things down significantly.

Late-season returns face higher risk of delay simply because of volume. When systems are busy, even small corrections can push a refund timeline back by weeks.

Risks of Filing Close to the Deadline

Waiting until the final days before the deadline can create several problems. If a required document is missing or a number is entered incorrectly, there may not be enough time to correct it before processing queues grow. A small typo can trigger a review, and reviews take time.

Late filing also increases the chance of penalties if taxes are owed. Interest and late fees begin building once deadlines pass. Many taxpayers assume there is flexibility, but the current structure suggests tighter enforcement and fewer informal grace periods.

Filing near the deadline also creates personal stress. When documents are rushed, mistakes are more likely. Careful review becomes harder when time is short.

Why Early Filing Supports Better Budget Planning

Early filing helps families plan their finances with more confidence. When a return is submitted early and accepted quickly, refund timing becomes easier to estimate. This helps households schedule bill payments, manage debt, and plan purchases more safely.

February is already a financially tight period for many people due to post-holiday expenses and winter bills. Receiving a refund earlier can help stabilize monthly budgets and reduce reliance on credit. Even a difference of a few weeks can improve cash flow planning.

Early filing also allows time to respond if the IRS requests additional verification. When returns are filed late, any follow-up request pushes the refund much further out.

Preparing Earlier Makes the Process Easier

The simplest strategy for the 2026 tax season is to start earlier than usual. Taxpayers should begin collecting income forms, deduction records, and identity documents well before the filing window opens. Employers and financial institutions usually send forms in January, so watching for them and organizing them quickly is helpful.

Reviewing last year’s return can also make preparation easier. It reminds taxpayers what documents were needed and what credits or deductions were claimed. Planning ahead reduces confusion and lowers the chance of missing important information.

Treating early February as a personal preparation deadline can be a practical approach. This creates a buffer period before the official deadline and reduces pressure.

Accuracy Matters More Under a Tight Schedule

With a stricter calendar, accuracy becomes even more important. Incorrect Social Security numbers, mismatched income amounts, or missing forms can all trigger delays. When verification systems detect mismatches, returns move into manual review, which takes longer.

Careful double-checking before submission is one of the best ways to protect refund timing. Using trusted tax software or qualified preparers can also help reduce errors. Accuracy saves time for both the taxpayer and the processing system.

Final Thoughts on the 2026 Tax Season

The confirmed 2026 tax calendar highlights a simple message: timing and preparation matter more than ever. Filing early, checking details carefully, and submitting electronically can significantly improve refund speed and reduce stress. Waiting until the last moment increases risk and uncertainty.

Taxpayers who adjust their habits and prepare ahead of the main filing rush will likely experience smoother processing and more predictable results. The calendar should be treated as a planning tool, not just a deadline reminder.

Disclaimer

This article is for informational purposes only. Tax filing dates, refund timelines, rules, and procedures may change based on official announcements and policy updates. Always verify details directly with the Internal Revenue Service or consult a qualified tax professional before making financial or filing decisions.