For millions of people in the United States who receive Supplemental Security Income (SSI), the payment date at the beginning of each month is extremely important. These payments help cover basic living expenses such as food, rent, and utilities. Normally, SSI is paid on the first day of every month. However, in early 2026, recipients noticed something unusual. The first three SSI payments of the year did not arrive on their usual dates. This caused confusion and concern for many beneficiaries.

The change in payment timing is not due to any new law or benefit reduction. Instead, it is the result of how the official payment schedule works when regular payment dates fall on weekends or federal holidays. Understanding this system can help recipients plan their finances more confidently and avoid unnecessary worry.

The Standard SSI Payment Rule

SSI payments are generally scheduled for the first day of each month. This is the standard rule followed every year. However, there is an important administrative guideline behind the scenes. When the first day of the month falls on a weekend or a federal holiday, payments are not sent on that day. Instead, they are issued on the last business day before that date.

This rule exists to make sure recipients receive their money on time and are not forced to wait because banks and government offices are closed. While the rule is helpful, it can sometimes create unusual payment patterns, especially when several months in a row are affected by weekends or holidays.

That is exactly what happened at the start of 2026.

What Happened to the January 2026 SSI Payment

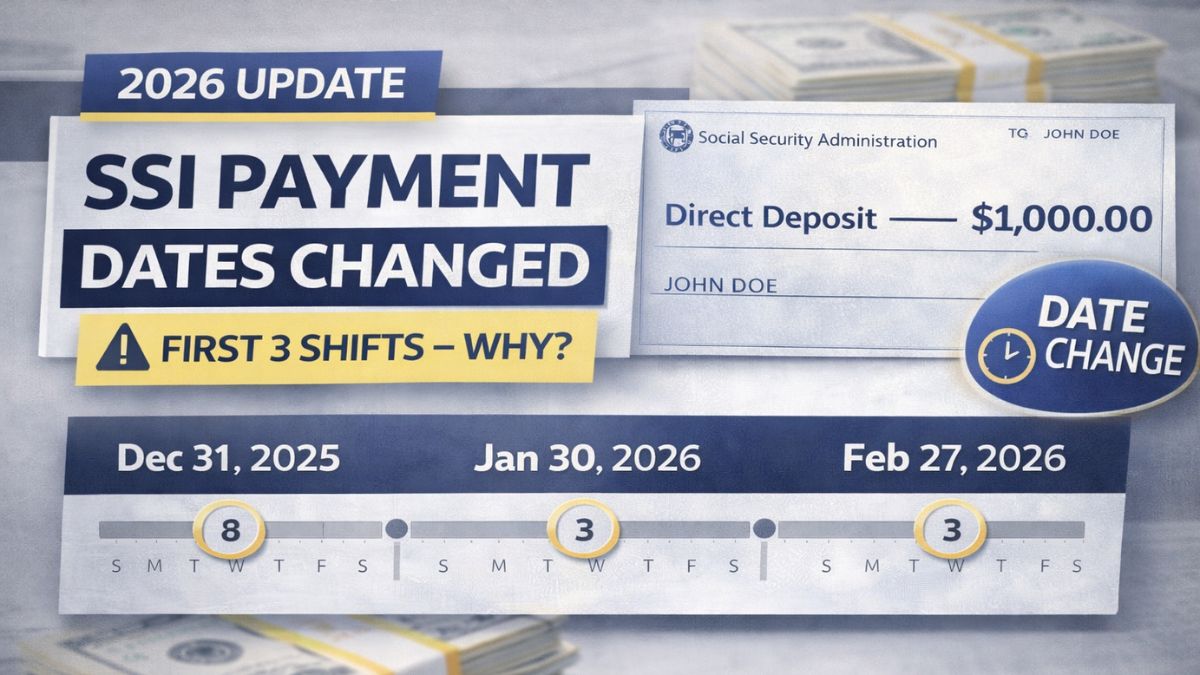

The first shift happened with the January 2026 payment. January 1 is a federal holiday every year. Because government offices and banks are closed on that day, SSI payments cannot be processed on January 1 itself. As a result, the January payment was sent on the last business day before the holiday, which was December 31, 2025.

This means recipients received their January benefit before the new year even began. While this may feel like a bonus at first glance, it is not an extra payment. It is simply an early deposit for January.

Some recipients mistakenly believe they received an additional payment, but in reality, it is only a scheduling adjustment.

Why February and March Payments Also Came Early

The pattern continued for the next two months. In 2026, both February 1 and March 1 fall on a Sunday. Since Sundays are non-business days, payments cannot be issued on those dates. Following the same scheduling rule, the payments were moved to the previous business day.

The February SSI payment was therefore issued on Friday, January 30, 2026. The March SSI payment was sent on Friday, February 27, 2026. This created a situation where recipients received payments near the end of the prior month instead of at the start of the benefit month.

Again, these were not extra payments. They were simply early deposits because the first day of the month was not a valid business day for processing.

How This Creates “Double Payment” and “No Payment” Months

Because of these calendar shifts, some months in 2026 will show two SSI deposits, while others will show none. This can be confusing if someone is not aware of the scheduling rule.

When a payment is pushed backward into the previous month, that earlier month may show two deposits close together. Later, the actual benefit month may appear to have no payment at all because the money was already sent in advance.

In 2026, this pattern will appear again later in the year. Some months will include two deposits — one for the current month and one early payment for the next month. Other months will look empty, even though beneficiaries are not missing any money overall.

This timing difference can make monthly budgeting more difficult, especially for households that rely heavily on SSI as their primary income source.

Budgeting Challenges for SSI Recipients

Irregular deposit timing can create real financial pressure. Many SSI recipients live on tight budgets and plan their expenses based on a predictable monthly schedule. When a payment arrives early, it must last longer than usual. Without careful planning, funds may run out before the next deposit arrives.

For example, when a payment is issued at the end of February for March, recipients must stretch that amount across the entire month of March. If spending is not adjusted, it can lead to shortages before the next scheduled payment.

Creating a monthly spending plan and tracking deposit dates in advance can help reduce stress. Looking at the full yearly payment calendar instead of only month-to-month timing is often the best approach.

Updated SSI Maximum Benefit Amounts

Along with the date changes, benefit amounts have also increased due to a cost-of-living adjustment. The annual COLA increase is designed to help benefits keep pace with inflation and rising living costs.

For 2026, the maximum federal SSI payment for an individual is $994 per month. For an eligible couple, where both partners qualify, the maximum combined payment is $1,491 per month. An essential person — someone who lives with and provides necessary care to an SSI recipient — can receive up to $498.

It is important to understand that these are maximum federal amounts. Not everyone receives the full figure. Actual payments are reduced based on countable income and other eligibility factors. Some states also provide additional state supplements, which can increase the total monthly benefit.

No Benefits Are Lost Due to Date Changes

One of the biggest concerns among recipients is whether early payments mean lost payments later. The answer is no. The total number of payments and the total yearly benefit amount remain exactly the same. Only the timing changes.

The system is designed to ensure that recipients are not disadvantaged by weekends or holidays. While the schedule may appear irregular, the full benefit is still delivered.

Understanding this process helps avoid panic and prevents misinformation from spreading among beneficiaries.

Disclaimer

This article is for general informational purposes only and is not official government guidance. Payment schedules and benefit amounts can change based on administrative decisions and individual eligibility factors. Recipients should always verify details through official government sources or by contacting their local Social Security office for personalized information.