The 2026 U.S. tax filing season is now in full swing, and many taxpayers are carefully watching their refund status. For millions of people, a tax refund is not just extra money — it is an important part of their yearly financial planning. With everyday living costs still high, including rent, food, healthcare, and utilities, knowing when a refund may arrive can help families manage their budgets better. February is usually one of the busiest and most important months for refund payments, especially for people who file their returns early.

Why February Is an Important Month for Tax Refunds

February is often the first major refund period of the tax season. Taxpayers who prepare and submit their returns early are usually the first group to receive payments. These early filers often include salaried workers, retirees, and households with straightforward tax situations. Many people choose to file early because they want quicker access to their refund money to cover expenses or pay off debts.

In recent years, early filing has increased because families want faster financial support. Historically, a large number of refunds are sent between the middle and the end of February. During this period, the tax authority focuses on processing large volumes of returns while also checking details carefully to prevent mistakes and fraud.

How Tax Returns Are Processed After Filing

After a taxpayer files an electronic return and it is accepted, it goes through an automated review system. This system checks income details, tax credits claimed, and the amount of tax already paid through withholding. If all the information matches official records, the refund is approved and moved forward for payment.

Electronic filing is usually much faster than mailing a paper return. Direct deposit is also quicker than receiving a paper check. When a return is filed on paper, it must be opened and reviewed manually, which can take significantly more time. Even small errors like missing numbers or incorrect calculations can slow down processing. That is why electronic filing with direct deposit continues to be the recommended method for faster refunds.

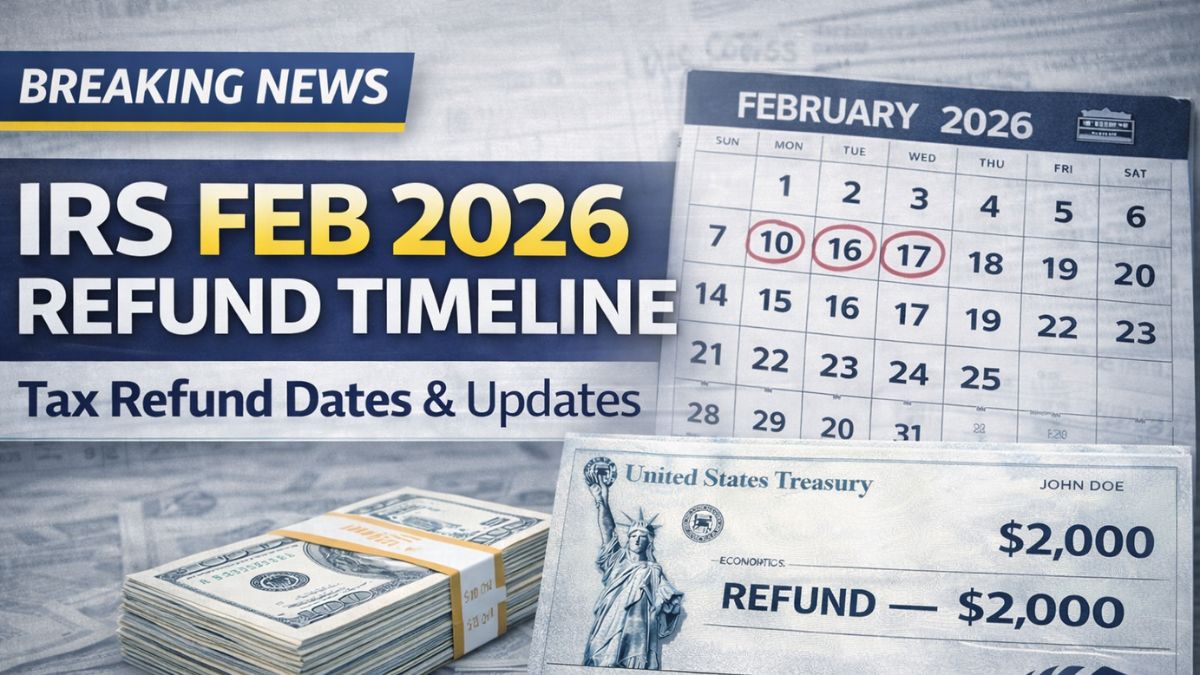

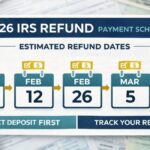

Estimated Refund Timing for Early and February Filers

Taxpayers who submitted their returns electronically in late January 2026 and selected direct deposit may begin receiving refunds in early February. Many of these payments are typically completed within about two to three weeks after acceptance, assuming there are no errors or special reviews required.

People who file during the first half of February often receive their refunds by the middle or later part of the month. However, not every return follows the same timeline. Some tax returns require additional checks, especially if they include certain refundable credits or unusual income situations. In such cases, refunds may arrive toward the end of February or even in early March. These extra reviews are part of fraud prevention and accuracy checks.

Common Causes of Refund Delays

Even when the tax season runs smoothly overall, some refunds are delayed. Incorrect bank account numbers are one of the most common problems. If the direct deposit details are wrong, the payment cannot be completed on time. Mismatched personal information, such as name or Social Security number differences, can also trigger a hold.

Simple math mistakes or missing entries may require correction before approval. Some taxpayers are selected for identity verification, which pauses processing until confirmation is completed. Returns that include amended information, prior-year corrections, or conflicts with employer-reported data may also require manual review. Submitting the same return again because of worry can actually make the delay worse, so it is usually better to wait and check status through official tools.

What Tax Professionals Are Seeing This Season

Tax professionals report that electronically filed returns with accurate information are moving through the system quickly in 2026. Clean returns with no unusual claims are often processed within the standard timeframe. However, returns that fall outside normal patterns are being reviewed more carefully.

Experts say that double-checking all entries before filing is one of the best ways to avoid delays. Even though the system is faster today than in the past, careful review is still necessary to keep refunds secure and correct. Patience is important because some reviews are routine and do not mean there is a serious problem.

How Refund Timing Affects Family Budgets

For many households, a February refund plays a major role in financial stability. Some families use the money to catch up on winter utility bills or rent. Others use it to pay down credit card balances from holiday spending. Some set it aside for emergency savings or future needs.

When refunds arrive on time, families often feel financial relief. When delays happen, people may need to rely more on borrowing, which increases financial pressure. This effect is especially strong for lower-income households and retirees who depend on fixed monthly income.

Broader Economic Impact of February Refunds

Tax refunds do not only help individual families — they also affect the wider economy. Every February, a large amount of money flows back into local communities through refund payments. People spend this money on essentials, repairs, education costs, and sometimes larger purchases.

This increased spending supports local businesses and services. When refunds are delayed across large groups, it can temporarily slow down this economic activity. That is why efficient processing is important not only for taxpayers but also for overall economic movement.

How to Check Your Refund Status Safely

Taxpayers can check their refund progress using official refund tracking tools once their return has been accepted. These tools show whether the return is received, being processed, approved, or scheduled for payment. Updates may not appear every day, but these sources are still the most reliable.

It is important to avoid depending on unofficial charts, rumors, or social media posts that promise exact payment dates. Refund timing is different for each person because every tax return is unique. Accurate filing and using official tracking systems remain the safest approach.

What Happens After February Processing

Refund processing does not stop after February. Taxpayers who file later or whose returns need extra review will continue to receive refunds through March and beyond. At present, there are no major announced changes to standard processing methods for the rest of the 2026 season. Responding quickly to any official notice and keeping records ready can help avoid additional delays.

Disclaimer

This article is for informational purposes only and is based on general tax processing patterns and standard procedures. Actual refund dates may vary depending on individual tax details, filing accuracy, verification requirements, and processing volume. Readers should always refer to official tax authority resources or consult a qualified tax professional for personalized advice.