The 2026 IRS income tax refund season is expected to draw strong attention from taxpayers across the United States. Over the years, tax refunds were often treated as extra money that people used for travel, shopping, or savings. Today, the situation is different. With higher living costs and tighter monthly budgets, many households now depend on refunds to manage essential expenses. Because of this, understanding the estimated refund schedule and how processing works in 2026 is more important than ever.

The IRS plans to begin accepting tax returns for the 2025 tax year in late January 2026. While the official calendar looks similar to past years, the internal processing systems and verification methods have become more advanced. These upgrades are designed to reduce fraud and errors, but they can also change how quickly refunds are approved and paid.

Expected Opening Date for 2026 Tax Filing

The filing season is expected to officially open around January 26, 2026. Returns submitted before the opening date are usually held and processed only after IRS systems begin full operations. The final filing deadline is expected to remain April 15, 2026, unless special calendar adjustments are announced.

Filing early can still be helpful, but it is no longer the only factor that determines how fast a refund arrives. The IRS now relies heavily on data matching and automated verification. That means accuracy and complete reporting play a bigger role than simply being first in line.

How IRS Refund Processing Works in 2026

When a taxpayer files a return, the IRS system runs several checks before approving a refund. It verifies personal details, compares income with employer and bank reports, and reviews claimed credits and deductions. With newer technology in place, these checks are more detailed than in past years.

Electronic filing remains the primary method used by most taxpayers. Returns filed online move directly into the IRS processing system and avoid manual data entry delays. Paper returns, on the other hand, must be opened and processed by staff, which can add weeks to the timeline.

The general guideline for electronically filed returns with direct deposit has traditionally been about 10 to 21 days for a refund. In 2026, this range still applies in many cases, but it is not guaranteed. Some refunds will move faster, while others may take longer depending on verification results.

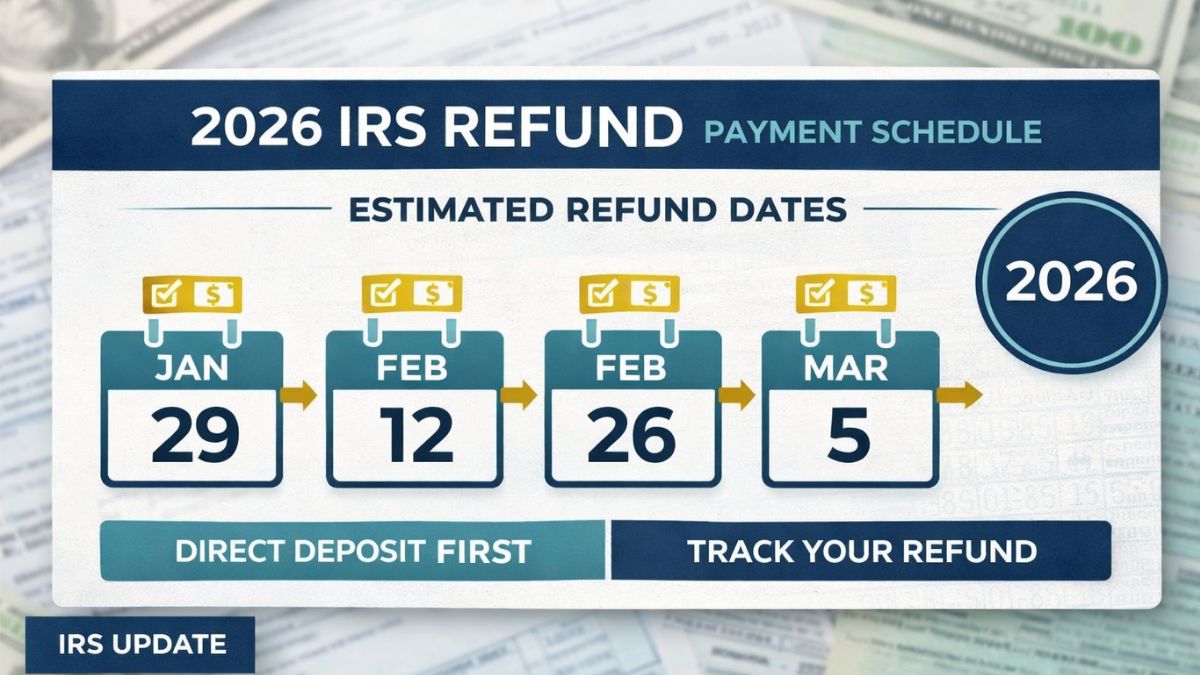

Estimated Refund Dates Based on Filing Time

Taxpayers who file electronically during the first days after the filing window opens and whose returns are accurate may start seeing refunds by mid-February. This estimate assumes there are no system flags, missing documents, or identity verification requests.

Returns filed in early February often fall into the next processing cycle, with refunds commonly arriving in the second half of February or early March. As filing volume increases, processing times can stretch slightly, especially during peak weeks.

Those who file closer to March or early April often still receive refunds within about three weeks if their returns are complete and error-free. The system works on a rolling basis, so each batch of returns moves forward as checks are completed.

Why Early Filing Does Not Always Mean Faster Refunds

For many years, taxpayers were told to file as early as possible to get their refunds quickly. In 2026, that advice needs more caution. Filing very early can sometimes lead to delays if third-party income reports are not yet fully updated in IRS databases.

Employers, banks, and payment platforms send income statements separately to the IRS. If a taxpayer files before those records are fully posted, the system may detect a mismatch and pause the return for review. In some cases, waiting until mid-February to file can actually reduce the chance of a data conflict.

The focus has shifted from speed of filing to accuracy of reporting. A carefully prepared return filed slightly later may move faster than an early return with incomplete data.

Tax Credits That Automatically Delay Refunds

Certain refundable tax credits continue to carry built-in refund holds each year. Credits related to low-to-moderate income workers and dependent children are subject to extra fraud screening under federal law. Because of this rule, refunds that include these credits are not released until at least mid-February.

Even if such a return is filed on the first day of the season, the refund will likely arrive in the last part of February or early March. This delay is standard and does not mean the return is incorrect. Families who claim these credits should plan their budgets with this timing in mind.

Digital Refund Payments and Reduced Use of Paper Checks

The IRS continues to push toward fully electronic refund delivery. Direct deposit into a bank account remains the fastest and most reliable method. Electronic payments reduce the risk of lost mail and speed up access to funds once a refund is approved.

Taxpayers without traditional bank accounts may receive refunds through prepaid debit cards or approved digital payment options. These methods improve access but may include small service fees. It is wise for taxpayers to review account terms before choosing an alternative payment channel.

Electronic delivery also makes tracking easier, since deposit confirmations appear quickly once funds are issued.

Common Reasons Refunds Get Delayed

Refund delays usually happen for clear reasons. Incorrect Social Security numbers, name mismatches, wrong bank account details, and missing income forms are frequent triggers. Automated systems quickly flag these issues and move returns into manual review.

Identity theft protection measures can also slow processing. If the IRS needs identity confirmation, it will contact the taxpayer with instructions. Refunds are released only after verification is completed.

Returns that include self-employment income, multiple jobs, or amended prior-year details often face longer reviews as well. More complex returns naturally require more checking time.

What the 2026 Refund Timeline Means for Households

Because refund timing is less predictable than many people expect, financial planning is important. Many households rely on refunds to pay down debt, catch up on bills, or build savings. Depending on an exact deposit date can create stress if processing takes longer.

Financial planners increasingly suggest treating refunds as uncertain-timing funds rather than guaranteed-date money. Flexibility in budgeting helps reduce pressure if a refund arrives later than hoped.

As the season moves forward and employer data becomes fully available, processing tends to become smoother and more consistent.

Final Thoughts on the 2026 Refund Season

The overall direction of the 2026 IRS refund schedule shows a system focused more on security and correctness than raw speed. While that may feel inconvenient for some taxpayers, it helps reduce fraud and payment errors. Filing electronically, checking all entries carefully, and using direct deposit remain the best ways to support faster processing.

Taxpayers who stay informed and prepare accurate returns are still in the strongest position to receive refunds without unnecessary delays.

Disclaimer

This article is provided for informational and educational purposes only. It is based on general IRS procedures and historical refund processing patterns. Actual refund dates, payment methods, and timelines may change and can vary by individual tax situation. This content is not tax or financial advice. Readers should consult official IRS resources or a qualified tax professional for guidance related to their specific circumstances.