As February 2026 gets closer, many Americans are hearing about a possible $2,000 federal direct deposit. Social media posts, blogs, and video headlines are creating the impression that a new nationwide payment is about to arrive for everyone. Because living costs remain high, including rent, groceries, utilities, and healthcare, it is understandable that people are paying close attention to this topic. However, the real situation is more careful and more limited than viral claims suggest.

There is currently no confirmed universal $2,000 payment approved for every American in February 2026. Most discussions are based on proposals, targeted relief ideas, and overlaps with existing benefit and tax systems. To avoid confusion and false expectations, it is important to understand how federal payments usually work and who may realistically qualify if any payment is approved.

Where the $2,000 Payment Idea Is Coming From

The $2,000 amount is often mentioned because it has been used before in past relief discussions and proposals. It is seen as a meaningful support amount that can help households handle short-term financial pressure. Over time, this number has become symbolic, so any rumor or proposal using it spreads quickly.

Current conversations connect this possible payment to existing federal systems instead of a brand-new program. That means if any relief is issued, it would likely move through channels that already send money to people, such as tax refunds or federal benefit programs. Using existing systems makes distribution faster and easier, but it also means strict eligibility rules usually apply.

Why February Is Often Linked With Federal Payments

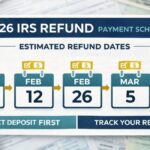

February is an important month in the federal payment cycle. By this time each year, most prior tax year records are available, benefit updates are active, and agencies have refreshed their data systems. Because of this, early-year adjustments and payments often happen during this period.

Tax filing season also begins around this time. Early filers who submit correct returns and choose direct deposit may receive refunds within a few weeks. At the same time, monthly benefit payments continue on their normal schedule. When refunds and benefits arrive close together, people may believe a special new payment has been sent, even when it is simply normal processing.

Administrative timing, weekends, and banking delays can also shift when deposits appear, adding to misunderstanding.

Who May Qualify Under Typical Federal Relief Rules

Even when federal relief payments are approved, they are rarely sent to every person without conditions. Most programs use income limits and eligibility categories. Lower and moderate income households are usually prioritized because they are more affected by rising living costs.

People who already receive federal benefits are often included early because their identity and payment details are already verified in government systems. This can include retirees, disabled individuals, and certain support program participants. Tax filers who recently submitted returns also tend to be easier to include because their income information is current.

Legal residency and valid identification numbers are normally required. People outside verified status categories are usually not included in direct federal cash payments. These rules explain why the phrase “for all” in viral headlines is often misleading.

How Payment Methods Usually Work

When the federal government sends money, it normally uses a few standard delivery methods. Direct deposit is the fastest and most preferred option because funds move electronically into bank accounts. Paper checks are slower because they must be printed and mailed. Some programs also use prepaid debit cards in limited cases.

People with correct banking details on file usually receive funds much sooner than those who rely on mailed payments. Errors in account numbers, closed bank accounts, or outdated addresses are common reasons for delay. That is why keeping records updated is very important whenever government payments are expected.

Why Payment Amounts May Differ From $2,000

Even if a relief payment uses $2,000 as a headline number, not every eligible person would automatically receive that exact amount. Many federal programs adjust payments based on income, household size, or benefit category. Some recipients may receive the full amount, while others receive a reduced figure.

Government payment formulas are individualized. Two households with slightly different incomes or family details can receive very different results. Viral posts rarely explain these calculation rules, which leads people to expect identical payments when that is not how the system works.

Offsets can also reduce payments. Certain unpaid government debts may be deducted before funds are delivered. This can lower the final amount received.

The Link Between Relief Talks and Inflation Pressure

Relief payment discussions in 2026 are strongly connected to ongoing cost pressure. Even though inflation rates may have slowed compared to earlier peaks, essential expenses are still higher than they were a few years ago. Housing, medical costs, insurance, energy, and food remain major budget challenges.

Because of this, policymakers often discuss targeted support instead of universal payments. Targeted programs cost less overall and focus on groups considered most financially vulnerable. That makes broad payments to every adult less likely than income-based or benefit-linked support.

Steps People Should Take to Avoid Missing Payments

When any federal payment is being discussed, preparation matters. People should make sure their tax filings are up to date and their banking information is correct with any agency that pays them benefits. Outdated records are one of the biggest causes of payment problems.

It is also important to rely on official announcements instead of social media claims. Government agencies publish updates on their official websites and verified channels. Waiting for confirmed guidance helps prevent mistakes and disappointment.

Scam Risks Increase Around Payment News

Rumors about large federal payments almost always attract scammers. Fraudsters send emails, texts, and calls pretending to represent government offices. They may promise to release a $2,000 payment in exchange for a fee or personal data.

Real government agencies do not charge fees to send relief payments. They do not ask for passwords or full banking credentials through unsolicited messages. Any message that creates urgency or asks for payment to unlock funds should be treated as suspicious.

Final Perspective on the February 2026 Payment Claims

The idea of a $2,000 federal direct deposit in February 2026 is based more on proposals and expectations than on confirmed universal policy. If any payment is approved, it will likely be targeted, rule-based, and distributed through existing systems. Not everyone would qualify, and amounts could vary.

The safest approach is to stay informed through official sources, keep records updated, and treat viral claims with caution. Clear information and realistic expectations are the best financial tools during periods of heavy rumor activity.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. It does not confirm that a universal $2,000 federal direct deposit will be issued in February 2026. Eligibility, payment amounts, and timing depend on official government decisions and individual circumstances and may change. Always verify details through official government sources before making financial decisions.