As the 2026 tax season begins, many people across the United States are searching for information about $2,000 direct deposits and early February refund dates. Online discussions often highlight specific dates such as 9 February 2026 and connect them with large refund payments. For many households, a tax refund is not just extra money but an important part of their yearly financial planning. It is commonly used to catch up on bills, reduce debt, or handle major expenses at the start of the year.

It is important to understand that refund timing is based on processing rules and filing behavior, not a guaranteed nationwide payout date. While some taxpayers may indeed receive refunds around that time, eligibility and timing depend on how and when the return is filed and what credits are claimed.

How the Tax Refund System Operates Each Year

When a federal tax return is submitted, it does not immediately result in a refund. The return first goes through a review and verification process. During this stage, reported income, withholding amounts, and claimed credits are checked against employer records and other submitted documents. The system also runs identity and fraud filters.

Only after these checks are completed does the refund move to approval and payment. If the return is accurate and complete, processing moves faster. If there are mismatches or missing details, the review takes longer. This is why two people who file on the same day can receive refunds at very different times.

Why Electronic Filing Speeds Things Up

The way a return is filed has a major impact on refund speed. Electronic filing is the fastest method because the data enters the processing system immediately. Automated checks begin quickly, and fewer manual handling steps are required.

Paper-filed returns move more slowly because they must be opened, sorted, and entered into the system by hand. During busy seasons, paper returns can sit in queues before processing even begins. This delay alone can add weeks to the refund timeline. Taxpayers who want faster refunds usually choose electronic filing for this reason.

Direct Deposit Is the Fastest Refund Delivery Method

After a refund is approved, the delivery method also affects how quickly the money arrives. Direct deposit is the fastest option because funds are transferred electronically to a bank account. There is no printing or mailing step involved.

When a paper check is requested, additional time is needed for printing, postal delivery, and bank clearing. Lost or delayed mail can extend the wait even further. Direct deposit also reduces risk and gives taxpayers quicker access to their funds. That is why most early February refunds are connected to electronically filed returns with direct deposit selected.

Why Early February Dates Like 9 February Appear in Discussions

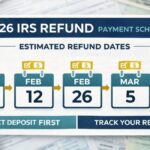

Specific early February dates often appear in refund discussions because they match estimated processing windows. If tax filing opens in late January and a person files immediately with a clean, simple return, a refund could be approved within roughly two to three weeks. That places some early refunds in the second week of February.

However, this is not an official guaranteed payment date for everyone. It is a projected outcome based on normal processing speed for early filers with no review issues. People who file later or whose returns need additional checks will receive refunds later.

Special Credit Claims Can Delay Refund Release

Returns that include certain refundable credits receive extra review by law. Credits designed to support working families and parents are subject to additional verification steps. Because of this rule, refunds connected to those credits are not released until mid-February at the earliest, even if the return was filed early and appears correct.

This delay is built into the system to reduce fraud and improper payments. Taxpayers claiming these credits should expect later deposit dates compared with simple returns that do not include them. This is one of the most common reasons why estimated refund calendars do not match actual deposit timing.

Common Reasons Refunds Take Longer Than Expected

Refund delays are not unusual and often have simple causes. Incorrect Social Security numbers, name mismatches, missing forms, and math errors can all slow processing. Identity verification requests also pause refunds until the taxpayer responds.

Banking detail errors are another frequent problem. If an account number is wrong or closed, the deposit fails and the refund must be reissued by mail. Address changes without updated records can also create mailing delays. Careful review before filing reduces the chance of these problems.

How Taxpayers Can Track Refund Progress

Refund tracking tools allow taxpayers to follow the status of their return after filing. These systems usually show when a return is received, when it is approved, and when payment is sent. Updates typically appear within a day after electronic filing is accepted.

Checking official tracking tools is far more reliable than relying on social media refund charts. Estimated calendars are helpful for general planning, but actual status tools reflect real processing progress for each individual return.

What Most Filers Should Expect in the 2026 Season

Most taxpayers who file electronically with correct information and choose direct deposit can expect refunds within a few weeks. Early filers may see deposits in February, while later filers may receive refunds in March or April. Timing depends more on filing behavior and return accuracy than on publicized dates.

Understanding this helps set realistic expectations. Not every taxpayer will receive a $2,000 refund, and not every refund will arrive in early February. Refund amounts depend on withholding, income, and credits. Processing time depends on accuracy and verification needs.

Setting Realistic Expectations About Large Deposits

Large refund deposits often attract attention, but they are not automatic or universal. A $2,000 refund usually reflects personal tax circumstances, not a standard payment amount. Each return is calculated individually. Comparing refund sizes between households can be misleading because tax situations differ widely.

The safest approach is to file accurately, file electronically, choose direct deposit, and monitor status through official tools. That combination gives the best chance of receiving any refund as quickly as possible.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. Tax refund timing and amounts vary by individual situation and processing conditions. Estimated timelines are not guarantees. Always refer to official tax authority resources or consult a qualified tax professional for guidance specific to your case.